Even Longer Duration Energy Storage Arrives

Electricity delayed for more than eight hours is required in most locations as they adopt more wind and solar. The delay extends with more adoption. There are partial offsets. Grids and their feeders increasingly stretching across time zones gaining extra hours of solar. For example the US spans coast-to coast. Ireland is electrically connected to Ukraine by interconnect through the rapidly-widening European grid. Imminent ultra-low-cost solar can be over-specified to add strong power production even at dawn and dusk. Norway is dominantly continuous hydro and France is strongly continuous (except for 2023) nuclear.

LDES vs alternatives

Unusually, a new Zhar Research report considers both LDES and its alternatives. It is “Long Duration Energy Storage LDES Reality: Materials, Equipment Markets in 35 Lines, Technology Roadmaps, Manufacturers, Winners, Losers, Alternatives 2024-2044”.

Dr Peter Harrop, CEO of Zhar Research observes,

“Relatively continuous sources of electricity are proliferating with google pioneering forms of geothermal that are more widely deployable and the European Commission targeting 1GW of open-ocean tidal and wave power by 2030. Add the UK showing leadership with wave and tidal and North America heavily investing. The need for seasonal storage will also be crimped by global warming giving us warmer winters and developing countries having warmer winters anyway. Demand timing can be reduced by appropriate pricing. Some UK LDES requirement is reduced by its feeder from abundant hydroelectric power in Norway and its planned feeder from solar in Africa. However, what remains is still a trillion-dollar global LDES requirement over the years.”

Suppliers will fall by the wayside

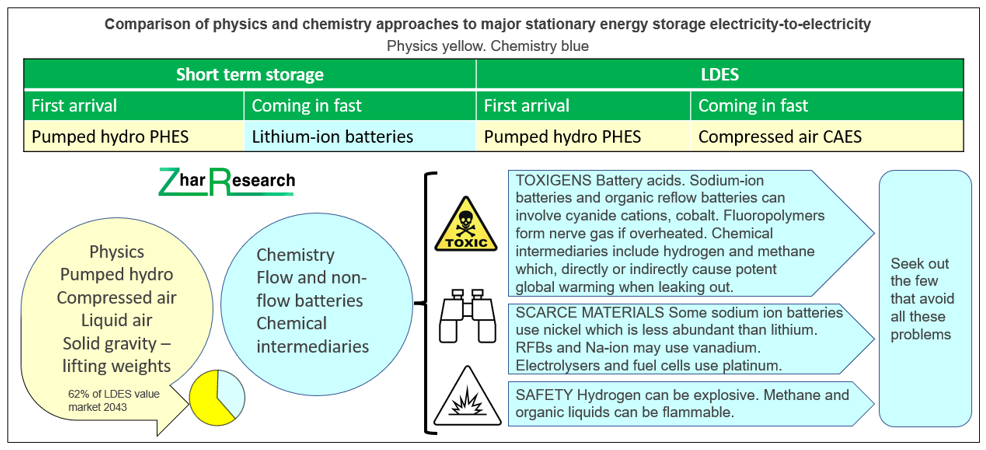

This is a race where companies and technologies fall by the wayside as the required delay and therefore duration of subsequent discharge extends. At eight hours duration at least 20 technologies gain orders – even lithium-ion batteries, for now. At 12 hours duration, almost all advanced conventional-construction ACCB batteries fail to compete. Critically, 12 hours is often enough to cover all supply and load changes for the full 24-hour day including solar dead at night. Increasingly, technologies with few or no toxigens will be favoured.

Few can cope with one week of intermittency

Next we see about one week of weak wind and solar compensated by up to four days discharge duration. This leaves Form Energy iron-air batteries with many large installations committed and more-scalable alternatives such as redox flow batteries RFB, liquid air, liquid carbon dioxide, lifting weights and - where massive earthworks are acceptable – storage from compressed air CAES or pumped hydro PHES. However, very few of these are being made at the necessary GWh for mainstream grid duration as yet. The largest RFB and solid gravity SGES versions are only at a few hours and not yet GWh.

New world of non-flammable, non-toxic, cheap materials, very long life

Now we sort the men from the boys, though we are not headed for a “winner takes all” scenario. This is a new world of non-flammable, often non-toxic storage, no scarce metals, few recycling issues and life up to 100 years. Only some contestants can serve short and long-term needs in one system. Few can cope with months of intermittency and the need will even extend to a modest amount of seasonal storage. Underground hydrogen is touted for up to seasonal but it wastes two to five times as much electricity every cycle so it cannot double as a short-term source .

Some need months

Heavily solar Queensland Australia says it will need at least 6GW of long duration energy storage. It will install PHES “to store energy over days, weeks or months.” This will probably include the largest PHES facility in the world. Three years ago, the UK hiked electricity prices because the wind died for several months and it had negligible storage and inadequate base load provision. The UK has few acceptable PHES sites so it backs work on advanced PHES working on mere hills and trials hydrogen and many other options.

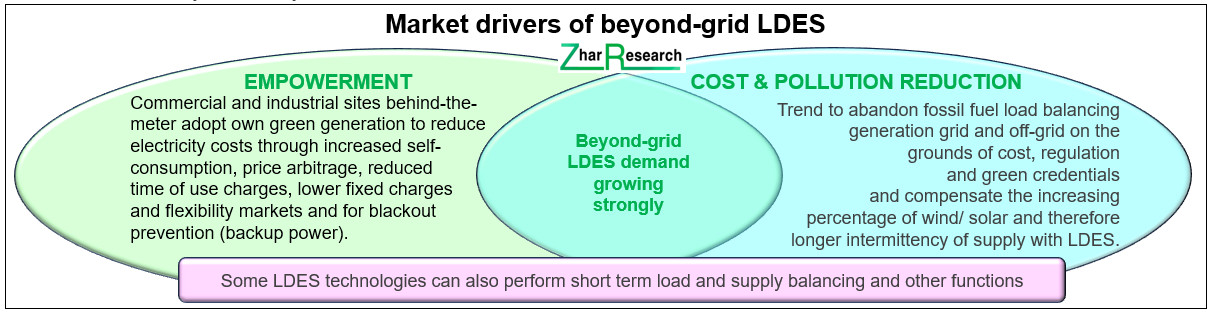

Perhaps all conventional-construction batteries have to give up here and even RFB, where scale-up means only larger electrolyte tanks, may struggle to compete with those massive earthworks for the biggest orders. However, there will be a large beyond-grid market emerging with needs that include small footprint and no massive earthworks. RFB and ACCB will probably win here as they gradually abandon valuable metals and becomes very affordable even down to solar buildings. For that emerging $20 billion yearly LDES market, see Zhar Research report, “Long Duration Energy Storage LDES beyond grids: markets, technologies for microgrids, minigrids, buildings, industrial processes 0.1-500MWh 2024-2044”.

Actual projects pulling ahead

For 24-100-hour duration covering up to weeks of intermittency, Invinity has a vanadium RFB order for a PNNL facility in the USA. EDF France and eZinc Canada have UK funding to trial vanadium RFB and ACCB options for a 24-hour storage system of up to 100kW. CellCube claims 24hr RFB. Elestor and Quino Energy develop it. See Zhar Research, “Redox Flow Batteries: 26 Market Forecasts, Roadmaps, Technologies, 48 Manufacturers, Latest Research Pipeline 2024-2044”.

Grids need massive capacity

Those are relatively small compared to the mainstream grid requirements but the 49-hour Bethel Energy Center is a 16GWh US CAES. The Pioneer-Burdekin PHES project in Queensland Australia plans 24-hour 120GWh. Ingula South Africa has 16-hour 21GWh PHES and Nant de Drance France has 22-hour PHES.

Two RFB companies say target “up to 100 hours” but Form Energy we mentioned is actually building several large 100-hour, iron-air grid ACCB. Corre Energy has agreement with Dutch utility Eneco for a possible 84-hour 26.9GWh CAES.

However, Dr Peter Harrop, CEO of Zhar Research warns,

“Several companies are cutting corners by leaping from small pilots to very large commercial facilities. That can end in tears. The end game will be winning technologies for grid such as PHES and CAES. For instance, Snowy 2.0 PHES in Australia will be able to run for more than seven days continuously, if necessary after a delay of weeks. It will be completed in 2026 and deliver 2GW, 350GWh, 100-year life. There will be different winning technologies for beyond-grid but both sectors will progress to price-competitive solutions that are up to one-month discharge duration, non-flammable and with 30-100-year life. The $5 billion winning operations will offer both grid and beyond-grid solutions but there will be successful niche players as well.”

Zhar Research reports and consultancy are available at www.zharresearch.com and www.giiresearch.com.

Press release distributed by Pressat on behalf of Zhar Research , on Thursday 28 December, 2023. For more information subscribe and follow https://pressat.co.uk/

Ldes Nuclear Energy Storage Energy Solutions Technology Microgrids Minigrids Buildings Industrial Hydrogen Batteries Global Electricity Computing & Telecoms Consumer Technology Education & Human Resources Government Manufacturing, Engineering & Energy

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

Even Longer Duration Energy Storage Arrives

News from this source: