When Will The Energy Storage Market Stop Growing?

The energy storage market in the form of delayed electricity is not immune to the familiar S curve. Indeed it will probably peak within the next twenty years and then it will drop due to several factors impacting successively.

Why the energy storage market will peak

The largest value market for energy storage is now electric cars. They are becoming oversupplied, commoditised and largely banned for cities. ReThinkX, with a formidable forecasting record, long ago predicted electric cars taking over and mostly selling at a collapsed $10,000 level long before that, battery included and electric cars at that price now sold in China. Electric cars already last longer and the battery can last as long as the car, so the replacement market will also ease. Economists predict a collapse of the Chinese economy. That would weaken its exchange rate, further reducing the dollar price of Chinese cars and their batteries. Little wonder that the USA is already planning 100% tariffs but most countries will welcome giveaway electric cars. The battery in our phones used to be 50% their cost but now far less: the same can occur with electric vehicle batteries. Any robotaxi replacements for cars will have ten times the utilisation and one tenth of the numbers.

Within 20 years there will be another hit on the energy storage market from mobile electronics becoming partly or wholly energy independent with little or no energy storage. That will be due to on-board multi-mode energy harvesting and Simultaneous Wireless Information and Power Transfer SWIPT. In about 20 years, it is possible that these many negative factors will outweigh the powerful growth sectors in the energy storage market that we now discuss.

Largest storage market becomes different

This year, the G7 committed to a quantitative global goal to increase energy storage in the power sector to 1500 GW in 2030—a more than six-fold increase from 230 GW in 2022. This advances the COP28 global goal to triple renewable energy capacity by 2030 and transform intermittent energy into reliable baseload power. It triggers similar efforts in the G20 and at COP29.

The largest value market for storage will therefore cease to be electric vehicles. It will become stationary storage, currently mostly a market for short-lived batteries compensating grid demand through the day but rapidly becoming primarily Long Duration Energy Storage LDES for grids and beyond-grid. Most of that will be provided by technologies such as pumped hydro. Add other gravity storage with many plants lifting blocks being erected in China and the British RheEnergise High-Density Hydro up mere hills being trialled. There is also a full orderbook for proven compressed air in underground caverns such as old salt mines. All of these can provide one tenth of the levelised cost of storage at the heroic 10GW sizes demanded. However, they can be repaired to last 100 years so the replacement market almost dries up.

Beyond-grid stationary storage will be huge

Eventually even your solar house will compensate for solar dead at night and on dull days. Meanwhile, with the trend to data centres, desalination plants and industrial processes, ocean islands and remote townships becoming energy independent – no fuel supply chains - the value market for off-grid and fringe-of-grid LDES may eventually exceed that for grids, but not within 20 years, the much larger number of units being 1GWh down to a few kWh.

Here, the LDES winner may be redox flow batteries RFB. Non-flammable, they can be rapidly installed almost anywhere, safely stacked for small footprint with few control or safety ancillaries needed. They will last at least 30 years with repair and serve one month duration (MWh/MW) at a fraction of the cost of ion-batteries. RFB will tumble in up-front cost and levelised cost of storage as it slowly transitions from vanadium to iron and compact hybrid forms.

Eventual saturation of the LDES market

The LDES market will eventually saturate because of minimal replacement business when batteries are ejected because of cost and inability to follow the market beyond 100 hours duration. Wind and solar power will become less dominant as less-intermittent alternatives such as the ocean wave, open sea tidal and reinvented geological power will become viable. Intermittency will reduce with interconnects linking grids from, for instance, Canada to Mexico or the UK to Africa and Ukraine across weather and day zones. Although LDES market saturation is probably more than 20 years away, another big change comes to it earlier.

Here comes all duration energy storage

Few have noticed that those new battery-free LDES technologies and RFB mostly have both efficiency and cycle life fine for managing short duration demand not just the low self-leakage, low-fade, and low cost in large sizes necessary for LDES. Two devices replaced by one, saving cost. In other words LDES may become All Duration Energy Storage, limiting value growth below the more wild-eyed forecasts. Grid storage that can only viably manage short term changes such as lithium-ion batteries and other ion-batteries get blown out of the grid market. The opposite will also be true. Hydrogen as intermediary means you lose about 70% every time you cycle – a disaster for managing busy short term fluctuations.

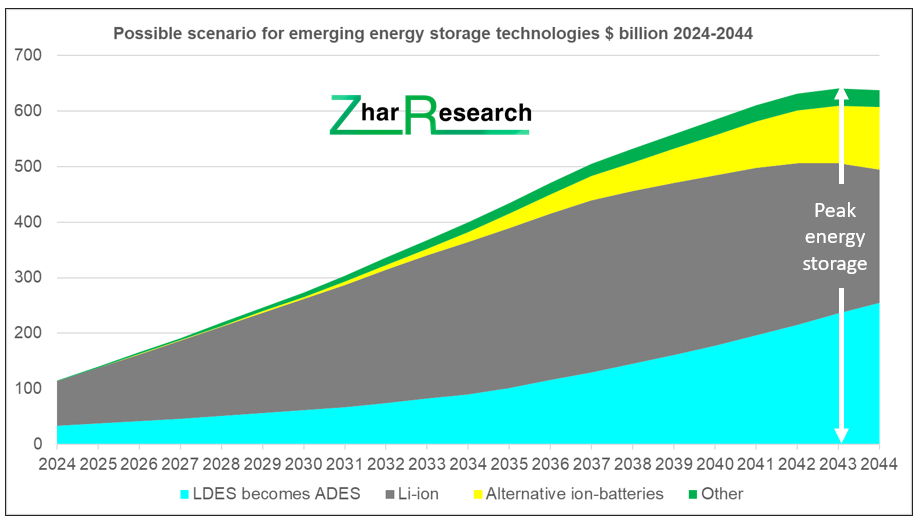

Possible scenario

Taking all this into account, a sixfold increase in the energy storage value market 2024-2044 is reasonable with saturation in about 20 years. We suggest that you use this scenario as a thought provoker and modify using your own insights but above all, disbelieve those many analysts that never show anything going down.

Many of the aspects covered in this article can be deeply understood from Zhar Research reports at www.zharresearch.com such as:

"6G Communications: Reconfigurable Intelligent Surface Materials and Hardware Markets 2024-2044".

Press release distributed by Pressat on behalf of Zhar Research , on Wednesday 22 May, 2024. For more information subscribe and follow https://pressat.co.uk/

Energy Storage 6g Supercapacitors Zero Energy Storage Zinc-Based LDES Lithium-Ion Redox Flow Batteries Batteries Technology Future Computing & Telecoms Consumer Technology Education & Human Resources Manufacturing, Engineering & Energy Opinion Article

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

When Will The Energy Storage Market Stop Growing?

News from this source: