Award-Winning RegTech Firm Muinmos Segments Its Regulatory Compliance Engine Ahead of New ESMA Guidelines That Targets Client Categorisations

“We have segmented our products in response to client feedback and we believe this is perfect timing for the new MiFID II guidelines from ESMA. In fac

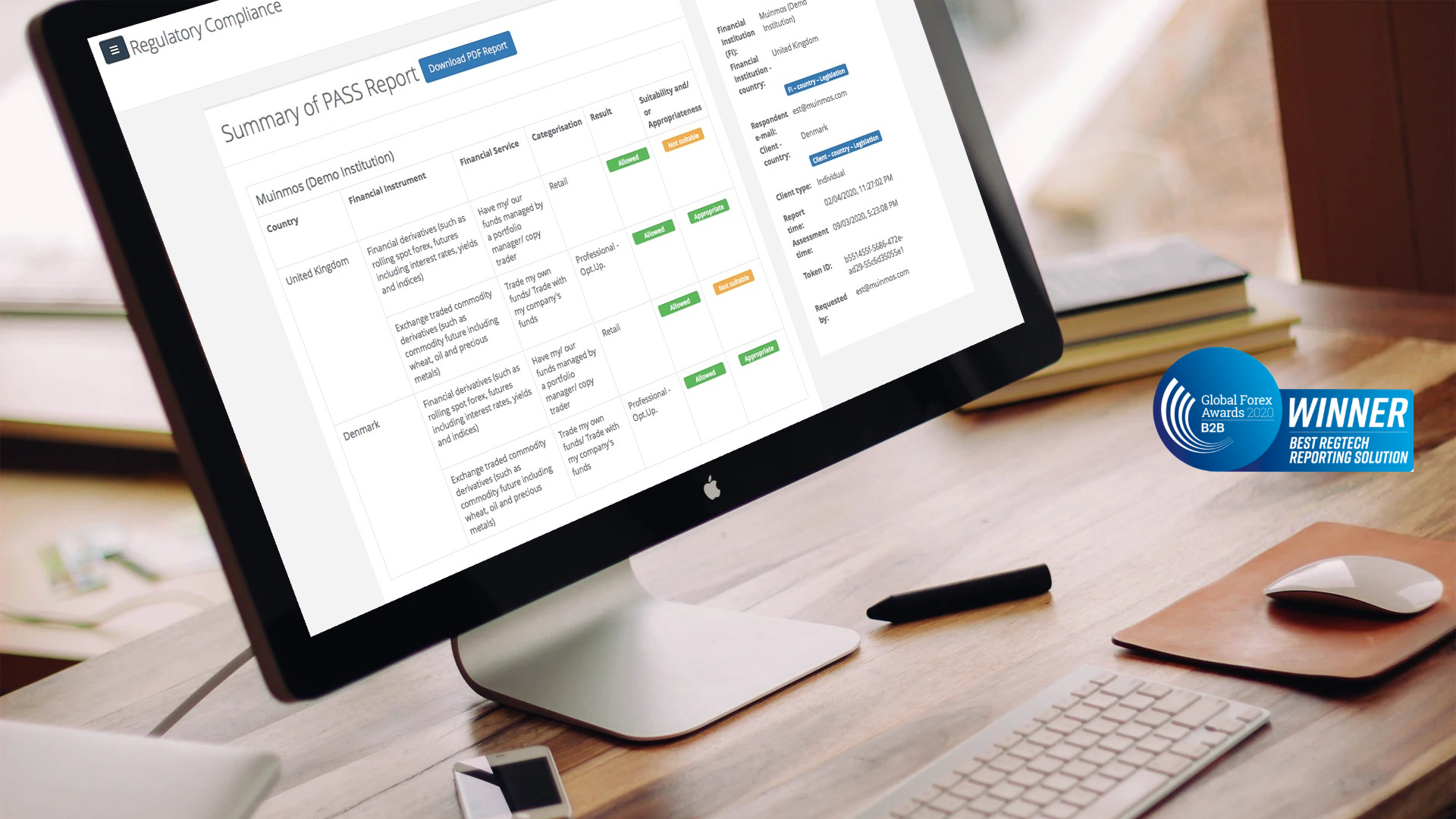

London, 6 August 2020 – Automated regulatory compliance specialist, Muinmos has successfully segmented its award-winning regulatory compliance engine into three separate product modules- mPASS™, mCHECK™ and mRX™. This will provide financial institutions greater flexibility and more options for their compliance teams as they prepare for new MiFID II client categorisation obligations mandated by ESMA (European Securities and Markets Authority) which came into play yesterday.

Each product module is available as a standalone application or as a whole under the Muinmos compliance engine.

The cloud-based, AI-powered Muinmos proprietary compliance engine features a full audit trail for management teams and/or regulators who have full control of their data which is available as a GDPR-compliant encrypted document storage service.

mPASS™ is a cloud-based, AI powered proprietary compliance module that enables any financial institution to secure continuous regulatory compliance and within seconds, determine whether a client can be on-boarded. This includes ensuring correct client categorisation from the outset, which is essential under new MiFID II guidelines in order to know which products and services to sell to them, to protect both the financial institution and the clients, and to avoid significant fines for regulatory breaches.

The compliance engine also encompasses a highly rigorous and reliable KYC/AML service mCHECK™, leveraging Muinmos’ multiple partnerships with AML data sources.

The third module is mRX™, a pioneering regulatory matrix, which provides risk assessments based on a number of parameters including jurisdictional, regulatory permissions, legislative and client risk assessments.

Financial institutions can cherry pick the product modules they need in order to complement or complete their compliance needs.

Remonda Z. Kirketerp-Møller, Founder and CEO, Muinmos explains, “We have segmented our products in response to client feedback and we believe this is perfect timing for the new MiFID II guidelines from ESMA. In fact, the recommendations from ESMA are the essence of what we have been advocating for years with regulators and clients alike. Muinmos is well-placed as the frontrunner in having a specific compliance solution that effectively meets these new guidelines fully."

“Many compliance teams previously prioritised KYC and AML above client categorisation but are increasingly realising the importance and complexity of client categorisation especially as financial institutions are rapidly taking on more cross-border business."

“Our clients are reaping the benefits in terms of speed and accuracy of using AI-based technology to enable them to correctly categorise clients and gain an overview of the suitability and appropriateness of financial products they wish to offer and market to them. Correct client categorisation is absolutely critical from the outset. Of course, KYC and AML remain important, but they should be seen as a piece within the puzzle as opposed to the leading component.”

Muinmos Expands Globally

Muinmos’ regulatory compliance engine significantly shortens the time of commencing a business relationship and opens up new opportunities for financial institutions in their provision of financial services across the globe. It has been rapidly gaining traction in Europe, particularly over the last year, and has recently focused on global expansion, primarily through the opening of an office in Singapore and the availability of mPASS™ in Simplified Mandarin, ideal for onboarding clients from China, Hong Kong and Taiwan.

Muinmos has witnessed a recent uptick in the number of Singapore-headquartered financial institutions with operations in the UK and Europe. It has also successfully secured a leading financial institution in USA as an anchor client and will begin exploring that market fully.

Remonda Z. Kirketerp-Møller concludes, “We are certainly seeing the benefits of a growing interest in RegTech solutions which enable compliance teams to increase efficiencies and operate more effectively. The regulatory environment is increasingly complex and our proprietary engine has been designed to simplify the onboarding process and to enhance the compliance process.”

Press release distributed by Pressat on behalf of Muinmos ApS, on Thursday 6 August, 2020. For more information subscribe and follow https://pressat.co.uk/

Muinmos ESMA Client Categorisation Regulatory Compliance Financial Institutions Europe Asia USA Financial Products Financial Services Business & Finance Crypto Currency Government Public Sector & Legal

You just read:

Award-Winning RegTech Firm Muinmos Segments Its Regulatory Compliance Engine Ahead of New ESMA Guidelines That Targets Client Categorisations

News from this source: