Why are payday loans legal? Cashfloat releases a research summary exploring possible answers.

Many are strongly against payday loans, but if they're so bad, then why are payday loans legal? Is there another suitable option?

Payday loans are a controversial topic. Should they be banned? Heavily regulated? Are they just legal debt traps? As a payday lender, Cashfloat is in the middle of it all.

Western Circle Limited, a premium payday lender trading as Cashfloat.co.uk, has released research (read it here) exploring the payday loan industry in the UK. The question tackled was: why are payday loans legal? Cashfloat brings together wide variety of statistics and information to provide a comprehensive view of the possible solutions for the payday loan industry.

Here are some key points brought up in the research:

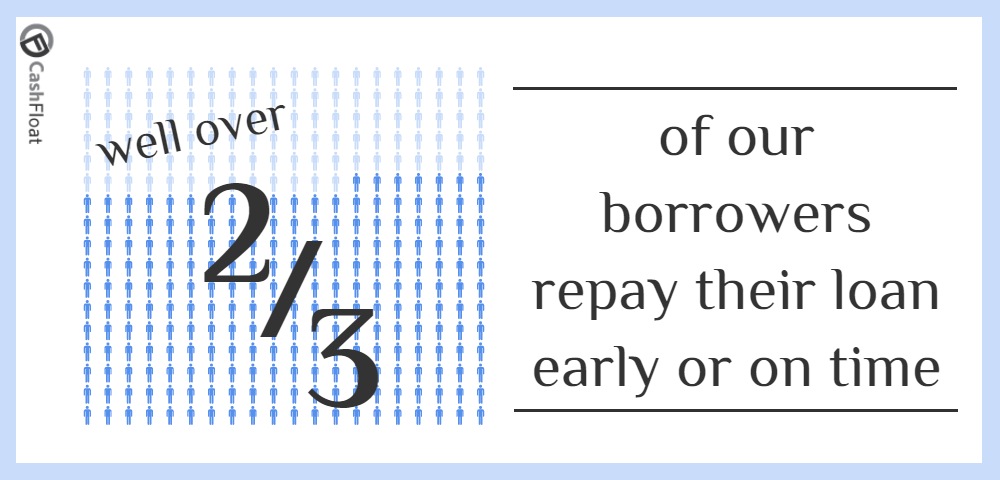

- Our own statistics say that well over two-thirds of our borrowers repay their loans early or on time, indicating that borrowers are fully aware of what they are signing up for.

- After payday loan were banned in some states in America, the numbers of returned cheques and the income banks made from overdraft fees increased.

- The current FCA regulations provide a safety net for the borrower, but are they enough? Read our analysis.

“This research brought up a lot of key points, and uncovered some interesting common misconceptions. The payday loan industry is one of the most hated industries, so it’s fascinating to look at it objectively, using statistics and external studies to uncover some truths about the industry. It’s an easy read, and I’d really recommend it for anyone with an opinion on payday loans,” says Elizabeth Redfern, head researcher.

What’s in the report?

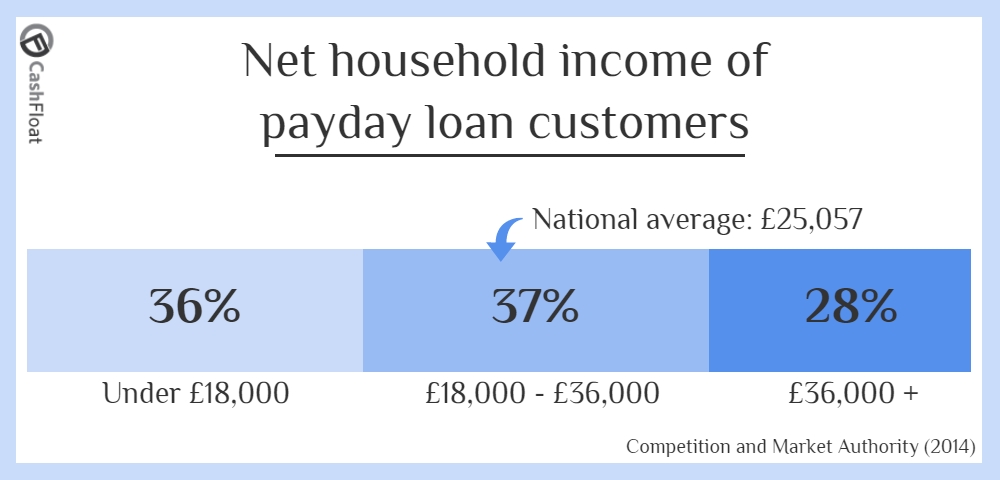

Cashfloat begins the investigation with a look at whether payday loans are as unreasonable as they are often portrayed to be, and discuss whether they ever actually help people. Do payday lenders prey on the unaware? Statistics seem to indicate otherwise. Using their unique position as a payday lender, Cashfloat looked at their own data to see how people are coping with their loans.

The article then discusses the possible impact on individuals and the national economy of a complete ban on the payday loan industry. It points to various studies performed in the USA, where individual states each have their own regulations ranging from complete bans to no restrictions on the industry at all. This provides an interesting opportunity for many statistical analyses of the effects of banning payday loans. The results of these studies were often quite surprising.

Are there any suitable alternatives to an outright ban? The option of heavily regulating the industry is explored, followed by a discussion on how successful the current FCA regulations are in protecting the safety of borrowers. Read the full report here.

About Cashfloat

Cashfloat.co.uk is a trading style of Western Circle Limited; an FCA-fully authorised direct lender. The Cashfloat model is based on fundamentally good morals and very advanced artificial intelligence technology designed to help and protect people taking payday loans online.

Contacts

Kelly Richard, 020-3757-1933

kelly.richard@cashfloat.co.uk

Ofer Valencio Akerman (SEO and Security)

akerman@masterlevelseo.com

Social Media Accounts

- www.cashfloat.co.uk

- https://www.facebook.com/cashfloat

- https://twitter.com/cashfloat_kelly

- https://www.linkedin.com/company/cashfloat

- https://plus.google.com/+CashfloatUk-loans

Press release distributed by Pressat on behalf of Cashfloat.co.uk, on Friday 30 June, 2017. For more information subscribe and follow https://pressat.co.uk/

Payday Loans FCA Regulations Payday Loan Regulations Short Term Loans FCA Regulations Ban Payday Loans Short Term Loans Business & Finance Government Personal Finance

Published By

020 3757 1933

kelly.richard@cashfloat.co.uk

https://www.cashfloat.co.uk/

Online Strategy: akerman@masterlevelseo.com

Visit Newsroom

You just read:

Why are payday loans legal? Cashfloat releases a research summary exploring possible answers.

News from this source: