UK’s Medical Cannabis Boom: Patients, Demand and Consumption Surge to All-Time Highs

By 2028, the number of medical cannabis patients in the UK is expected to increase by 124% to approximately 141,000 patients

The UK is the primary driver of new growth in Europe’s medical cannabis market, with sales of medical cannabis greater than expected due to ‘unusually high’ consumption volumes on a per-patient basis.

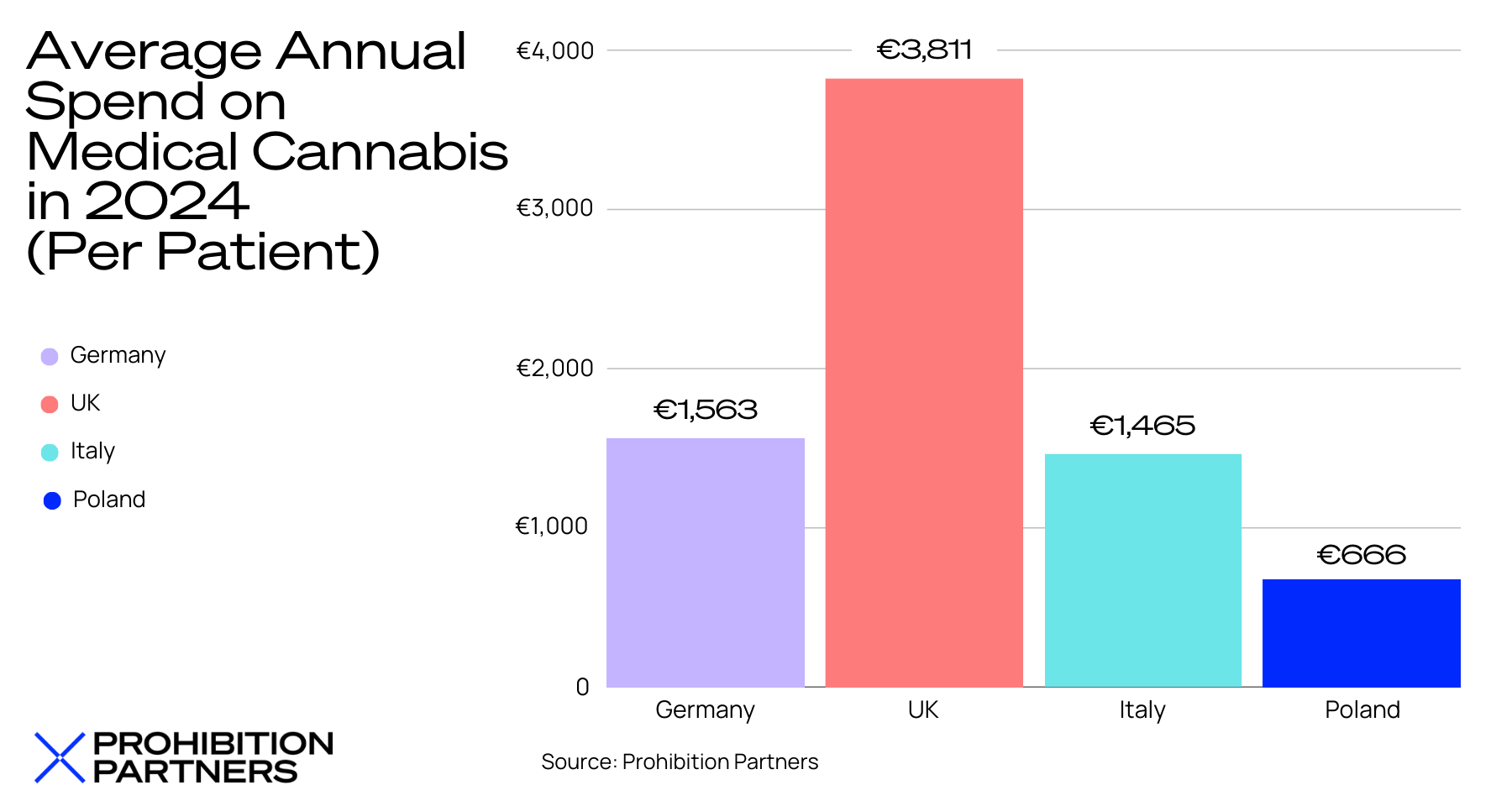

By the end of 2024, for example, 62,960 patients are forecasted to be using medical cannabis in the UK, generating €240 million (£205 million) in sales, meaning the average medical cannabis patient in the UK will consume €3,811-worth (£3,261) of medical cannabis per year, or €318-worth (£272) per month.

Compare this to Germany, with the largest medical cannabis market and patient population in Europe, where the average medical cannabis patient will consume €1,563 (£1,342) of medical cannabis per year, or €130 (£112) per month.

Average prices paid per gram of dried medical cannabis flower or millilitre of oil are lower in the UK than in Germany, so the primary factor contributing to this staggering 144% difference in spend is an even larger divergence in consumption volumes.

These findings have been published today in a new report from UK-based cannabis data and intelligence company, Prohibition Partners.

Why So High?

Speaking about the potential reasons for the high consumption rates in the UK compared to other European countries, Lawrence Purkiss, Senior Analyst at Prohibition Partners, said: “The comparatively high per-patient consumption rates in the UK are at least in part a consequence of the fact that the market is entirely private and self-paid. The financial incentives within the system are geared towards high prescription volumes, unlike in Germany where at least 50% of patients have their medical cannabis costs reimbursed under public healthcare.”

Stephen Murphy, co-founder and CEO of Prohibition Partners, added: “The findings in the 9th Edition of The European Cannabis Report highlight an intriguing trend: patients in the UK are consuming more than their counterparts in other European markets. Since the legalisation of medical cannabis in 2018, private companies have aimed to enhance options and accessibility for patients. However, due to supply chain restrictions and costs, patients often opt for volume over frequency. This underscores the need for continued efforts to streamline regulations and improve affordability to ensure patients' needs are adequately met.”

UK Market & Patient Explosion

Growth in the total number of medical cannabis patients in the UK is also forecast to soar over the next four years. By 2028, the number of medical cannabis patients in the UK is expected to increase by 124% to approximately 141,000 patients (up from approx. 63,000 by the end of 2024).

By comparison, in Germany the growth rate is just 24%, with approximately 346,000 medical cannabis patients anticipated by 2028 (up from approx. 278,000 by the end of 2024).

Together, Germany and the UK will account for 77% of all medical cannabis sales and patients in Europe by 2028 (Germany 50%, UK 27%).

Private Clinics Driving Growth

Although medical cannabis was legalised in the UK in November 2018 and is technically available on prescription through the National Health Service (NHS), patient access to medical cannabis in the UK is almost exclusively facilitated by private clinics.

These clinics are supplied by large medical cannabis distributors like Curaleaf Laboratories. Of the growth in sales and patient population in the UK, Jonathan Hodgson, CEO of Curaleaf Laboratories, said: “The beginning of 2024 has already shown a tremendous level of growth, with a record number of UK private clinics now providing medical cannabis treatment for lower appointment costs than ever before. More formulations and dosage forms have entered the market, such as pastilles and liquid vape cartridges, broadening the treatment options available for specialists to prescribe for patients.”

These medical cannabis findings have been published today in a new report - The European Cannabis Report: 9th Edition - by UK-based cannabis data and intelligence firm, Prohibition Partners. A version of the report is now available to download for free via the Prohibition Partners website.

ABOUT PROHIBITION PARTNERS

Prohibition Partners is a data, media and tech company operating in the fast-growing legal cannabis industry. We provide the industry with specialist information and data analytics.

For additional comment, more information about the report or visualisations of data, please contact Mike Hoban - michael@prohibitionpartners.com

Press release distributed by Pressat on behalf of Prohibition Partners, on Thursday 9 May, 2024. For more information subscribe and follow https://pressat.co.uk/

Cannabis Medical Cannabis Health Healthcare Wellbeing NHS Patients Pharmaceuticals Business & Finance Environment & Nature Farming & Animals Food & Drink Government Health Lifestyle & Relationships Medical & Pharmaceutical Public Sector & Legal

Published By

07841697433

michael@prohibitionpartners.com

https://prohibitionpartners.com/

info@prohibitionpartners.com

Visit Newsroom

You just read:

UK’s Medical Cannabis Boom: Patients, Demand and Consumption Surge to All-Time Highs

News from this source: