UK Business Owners Aren’t Letting Brexit Phase Them

74.18% said it would only have a slight effect, no effect or improve their business

UK Business Owners Aren’t Letting Brexit Phase Them

Global alternative business finance company, Capify, finds UK Business Owners Remaining Positive After Shock Brexit Result

MANCHESTER- July 1st, 2016 - Now the dust has started to settle after last week’s vote to leave the EU, it’s time to look into how it will affect SMEs and most importantly, how they can continue to grow through turbulent times.

Capify, a global business finance company has conducted a survey amongst UK business owners with over 1000 respondents.

What did UK business owners say?

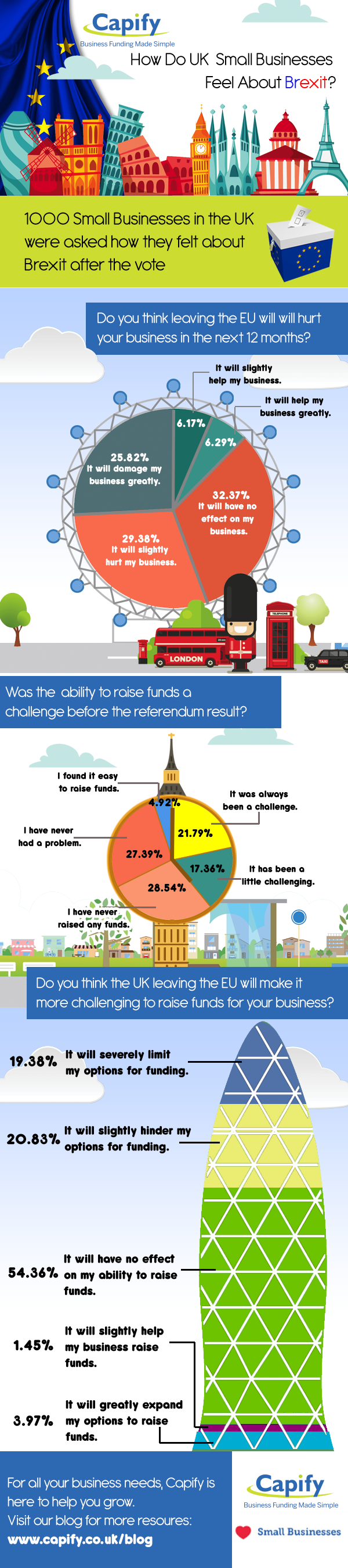

- Do you think the UK leaving the EU will hurt your business in the next 12 months?

- 25.82% said it will damage their business greatly

- 74.18% said it would only have a slight effect, no effect or improve their business

- Was the ability to raise funds a challenge for your business before the referendum?

- 21.79% said it is always a challenge

- 17.36% said it was a little challenging

- 28.54% said they have never raised any funds

- 27.39% said they have never had a problem raising funds

- 4.92% said they find it easy to raise finance

- Do you think the UK leaving the EU will make it more challenging to raise funds for your business?

- 19.38% said it will severely limit their options for funding

- 20.83% said it will slightly hinder their option for funding

- 54.36% said it will have no effect on their ability to raise funds

- 1.45% said it will slightly help my business raise funds

- 3.97% said it will greatly expand my options to raise funds

It is claimed business owners likely won’t be affected by the drop in sterling until later on in the year so this gives SMEs time to prepare. The leaders of Britain’s Chambers of Commerce also met last week with the FSB and together they want to continue providing economic stability for small firms and driving economic growth.

Despite high street banks announcing more closures of local branches and cutting lending to SMEs, it turns out the majority of business owners are still feeling optimistic about their funding options. Alternative finance has now become such a popular way to raise funds efficiently, SMEs know that they will continue to be supported by innovative lenders. The alternative finance market grew by 83.91% from 2014-2015*.

If businesses need additional capital to continue thriving, it could actually be a good time to go out and raise funds. Alternative finance works really well with all types of businesses and the strongest of SMEs know how to withstand turbulence by maintaining growth in changing environments.

Tony Pegg, CEO of Capify says, “When the results were announced on the 24th June, many people were left feeling shocked and uncertain about their future. There’s also been lots of negative comments made in the news, causing people to feel even less confident. However, we need to look at this in a positive light, we all had the chance to vote and we chose to leave. For many years, the UK has had a strong economy, ranking fifth in the world, the EU also made our business owners stick to strict and often ridiculous regulations and now we are free of that. I am happy to see that many business owners are still feeling positive about their future, as long as they continue to work hard and adapt accordingly, they will thrive.”

It’s an exciting time to be running a business, regardless of sector. If any owners are still feeling wary, wondering whether the banks will lend to them, they shouldn’t worry as there remains to be lots of options out there, such as alternative finance.

This survey has given us a true insight into what business owners are really feeling about Brexit. Many are un-phased by the results and will continue to carry on looking after their livelihood regardless. They also know that they will still be able to access the funds needed to grow and thrive despite economic uncertainty. For those who are still worried, they will continue to be supported by everyone in the UK including their fellow business owners and consumers.

About Capify

Capify (formerly United Kapital and Capiota in the UK) is a leading alternative finance provider for SMEs. Capify leverages a proprietary technology-enabled underwriting platform to provide working capital solutions to small- and medium-sized businesses in the UK, USA, Australia, and Canada. Capify has provided over £70 million to UK SMEs and over £400 million globally to SMEs in the markets it operates in. Business owners can apply online and receive decisions in 60 seconds or less at the company’s various websites. For additional information about Capify in the UK, visit www.capify.co.uk or you can learn more about the Capify global brand at www.capify.global.

Spokesperson for Capify : Managing Director Tony Pegg

Contact Number: 07545644900

Press release distributed by Pressat on behalf of Capify, on Monday 4 July, 2016. For more information subscribe and follow https://pressat.co.uk/

Business Finance Sme Brexit Funding Business Growth UK Business Owners Business & Finance

You just read:

UK Business Owners Aren’t Letting Brexit Phase Them

News from this source: