SendSpend’s Payment System for the Un-Banked poised to become frontrunner in race with Payment Giants.

"Our goal is to enable economically marginalised consumers to participate in the digital economy by having access to financial services"

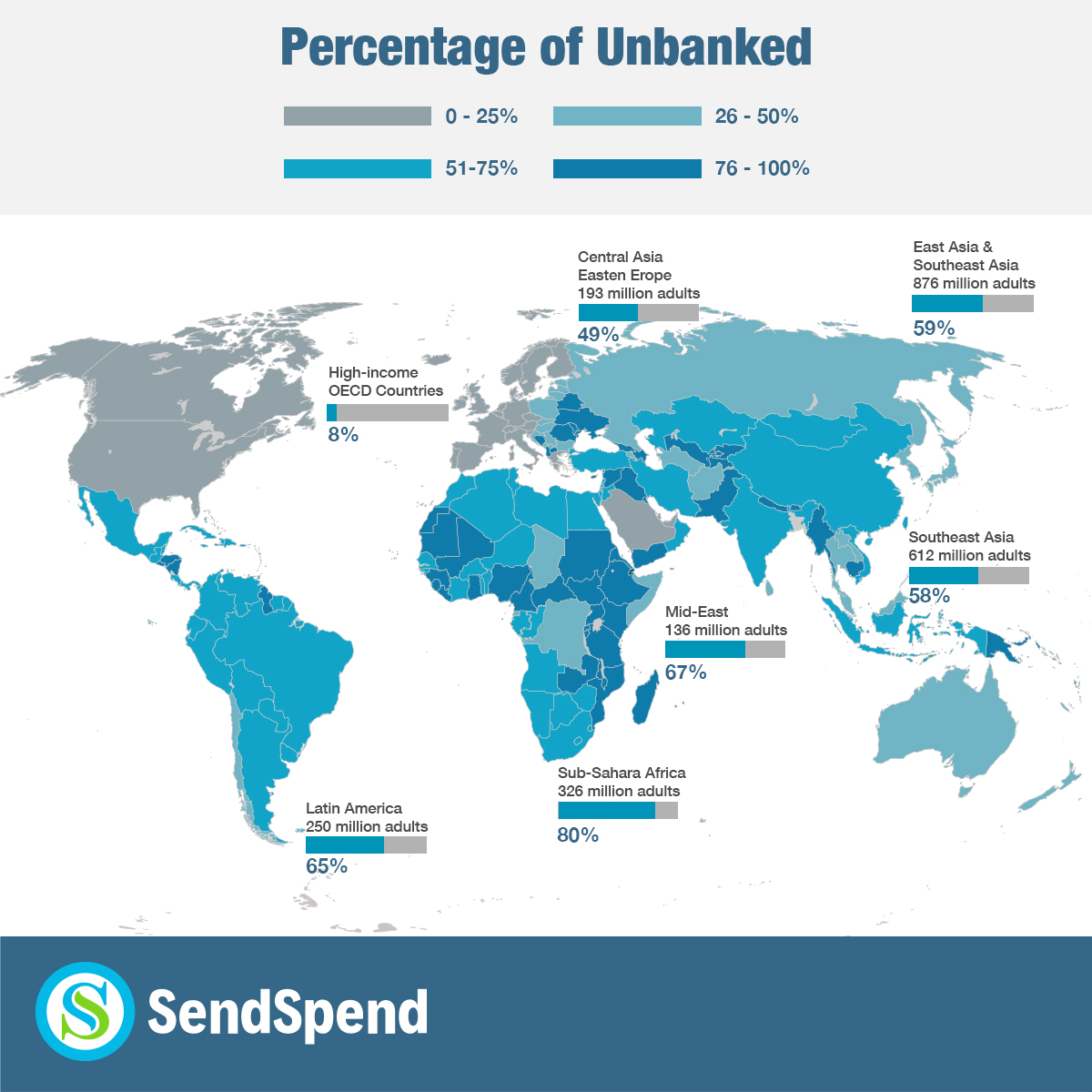

The World Bank estimates there are 1,7 billion people globally with no form of a bank account. However, two-thirds of this population has access to a mobile phone.

These findings are the driving force behind SendSpend, a London-based fintech, which has launched a global payment system based on cloud and mobile technology, enabling the unbanked to pay online and remit money instantly to each other using only a smartphone.

The platform, which has already launched in South Africa, is entirely digital, free for consumers, and you can use SendSpend within minutes of registering via a downloaded App.

Unlike most other mobile payment systems, which are either linked to a bank account, a traditional payment card, or a mobile operator, SendSpend isn’t. It is owned and operated by SendSpend. This eliminates unnecessary costs and complexities in the supply chain, enabling a much more affordable and user-friendly service to merchants and consumers.

SendSpend’s technology includes:

• Customer e-Wallet App

• Agent Services App

• e-Commerce and POS Payment Gateway including QR Code functionality

• Suite of API’s for corporate integration

• FX Suite for multi-currency transactions

“We set out to develop a payment system that was affordable, secure and functional”, says Graham Davies, one of the two co-founders’ of SendSpend. “Also, SendSpend’s flexible and dynamic architecture enables us to adapt to different compliance and regulatory requirements encountered in different countries. This allows us to offer a full suite of services and functionality when competitors often can’t”.

Customers top up a virtual card or withdraw funds at one of the many SendSpend Cash In/Out Agents. Once the virtual card is loaded, funds can be spent at any participating merchant either by scanning a QR Code or by merely entering the registered mobile number into an online checkout. Peer-to-peer remittances within SendSpend are instant. All transactions are authorised from within the app, and two-factor authentication using an OTP is required for online transactions.

A unique feature is the Agent Search function allowing customers to find agents close by, similar to how you would find an Uber. Available agents are displayed on a Google Map, showing the distance and fees each Agent charges for a deposit or withdrawal, giving the consumer power to compare available options. Cash In/Out agents include mass-market retailers, township stores, and ATMs.

Unique Agent App takes Financial Services to the last mile.

A separate Agent App means any rural village can now have an Agent!

“Our Smart Agents are the backbone of SendSpend’s Agent Network”, says Tracy Andersson, SendSpend’s other co-founder. “We’re taking financial services right into the villages and rural areas that frequently pose a challenge to financial institutions. Consumers no longer need to travel long distances to collect a remittance. Our goal is to enable economically marginalised consumers to participate in the digital economy by having access to financial services like insurance, money transfers and online buying”

There are payment systems that can be used by the unbanked. However, their legacy has always been of a product developed firstly for the worlds banked population. They have failed to adequately accommodate the specific challenges of an individual with no formal banking facilities.

SendSpend is unique. It was built from the get-go to be an “end to end” electronic payment system for the unbanked. A system built with one thought in mind: To provide someone with physical cash in hand an affordable and immediate means to electronically pay someone else!

This is what sets SendSpend apart.

Boiler Plate

SendSpend Limited is a Fintech company headquartered in London, United Kingdom, with operations in South Africa and India. SendSpend Holdings (Pty) Limited, registered in South Africa, is an authorised Financial Service Provider (FSP# 50673) and certified by PASA as a Payment System Operator. SendSpend promotes financial inclusion of the unbanked through the SendSpend Payment System, a global, multi-currency, peer-to-peer payment system connecting merchants, consumers, and cash in/out services via a series of APIs, Payment Gateways and Smart Phone Apps. The SendSpend App’s are currently only available on Android.

#sendspendfinancialinclusion

Press release distributed by Pressat on behalf of SendSpend , on Tuesday 23 February, 2021. For more information subscribe and follow https://pressat.co.uk/

Alternative Mobile Payment Systems Un-Banked Emerging Markets SendSpend E-Wallet Financial Inclusion SpendSend Technology Fintech Cash-In Business & Finance Charities & non-profits Computing & Telecoms Consumer Technology Entertainment & Arts Government Leisure & Hobbies Personal Finance Travel & Tourism

You just read:

SendSpend’s Payment System for the Un-Banked poised to become frontrunner in race with Payment Giants.

News from this source: