Long Duration Energy Storage: Physics or Chemistry

Money is being pumped into pumped compressed- and liquid-air grid energy storage. Pumped hydro is the benchmark it but has too few acceptable sites. The full picture of your huge business opportunities arising is given in the new Zhar Research report, “Long Duration Energy Storage LDES Markets 2023-2043: Grid Microgrid Delayed Electricity 6 Hours to Seasonal”.

Gravity storage lifting blocks has its first big orders. Both a study from the International Institute for Applied Systems Analysis and the developers propose that decommissioned mines could be repurposed to operate gravity batteries, lifting and dropping rocks. With $1-10 per kWh investment cost and $2k/kW power capacity cost, they say it could store 7-70TWh globally but for some mines pumped hydro is better. No mine and no water? Erect a massive building lifting and dropping rocks even in a desert.

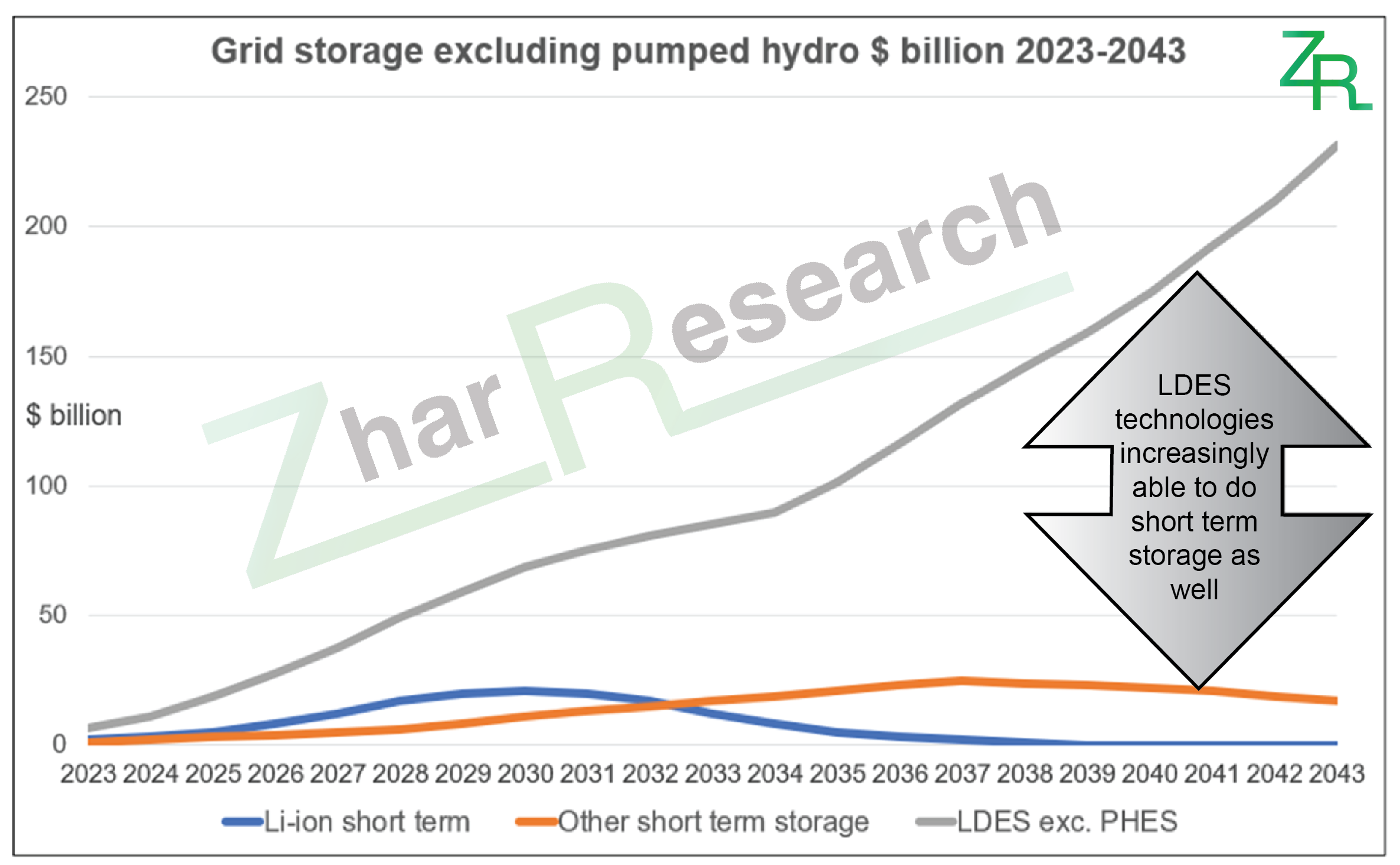

All those options could be called physics, ultimately capable of serving two needs. These are a) the emerging need for Long Duration Energy Storage mainly compensating irritatingly on-off wind and solar and b) today’s primary need which is managing short term loads through the day. Here, in an increasing number of cases you must now offer up to 12 hours of duration of discharge at full rating as the percentage of wind and solar in a given grid rises. Day and night. In ten years it will all look very different with the short-term storage need ceasing to grow and often becoming simpler. Sometimes, your grid will cease to wrestle with a complicated duck-shaped demand curve through the day but, with the aid of pricing structure, home battery-solar etc. face a simple chasm shape largely addressed by approaches not involving grid energy storage. Primary value market for grid storage will edge to 30-100 days duration, often serving 100% wind/ solar grids.

Windows of opportunity

Winston Churchill famously said that democracy is awful but all alternatives are far worse. The same is true of large lithium-ion batteries for grid storage but in this case many far better alternatives, particularly for the new needs, are arriving faster than commonly realised.

Lithium-ion battery economics fall off a cliff beyond 6 hours duration of discharge at full rated power. This is for several fundamental reasons in contrast to alternatives, some of which have scope to offer one tenth of that levelised cost of storage LCOS, particularly when scaled to the increasingly-necessary GWh sizes (longer delay means more GWh for a grid storage facility). Lithium iron phosphate cathodes currently favoured help with too few of the lithium-ion problems, so iron-air conventional batteries and iron-based redox flow batteries are in the frame. Something of an “iron age” with more iron for the both the chemistry options such as Form Energy conventional batteries and the massive steelwork of most emerging physics options.

De-risk investment

As for de-risking the eye-watering investment needed, Dr Peter Harrop, CEO of Zhar Research, puts it this way,

“Many of the aspiring technologies, using physics or chemistry, have response of seconds and are being trialled at short term duty cycles so it is not frivolous to ask if they can do both short and long term in one facility. Over their long life they may do both together or one or the other and back again according to the rather unpredictable future change in needs in a given location. That versatility will de-risk investment in them, something the accountants may wish to recognise beyond levelised cost of storage LCOS based on one, possibly wrong, scenario.”

Exciting new chemistries

New chemistries in conventional battery assemblies are mainly pitched to replace lithium-ion for short term storage and in vehicles etc. with the necessary high efficiency to cover all that cycling. Mostly they lack the low self-discharge and fade required for LDES and only a few viably scale to the necessarily massive capacity for LDES. Some do.

Chemical intermediary

Surplus green energy such as mid-day sun can make chemicals to sell - a splendid idea with excellent economics - but doing that as intermediary for delayed electricity is extremely inefficient so it is not proposed for short term storage. Many take it as a given that it can even do seasonal storage one day but many issues remain such as the fact that it leaks through anything, embrittles metals, causes fires and explosions, even global warming indirectly and underground caverns are probably essential. Enthusiasts promise to overcome most of these problems but no one pretends the inefficiency will lead to competitively executing all that cycling needed for short term storage.

Redox flow in the middle

Redox flow batteries RFB mostly serve microgrids. They have economy of scale in size but a relatively high LCOS. Vanadium versions are mature: a 2022 Chinese project installed a 400 MWh system. Other approaches use different materials and even the vanadium can be recycled. Investors like iron RFB in the form of ESS Inc addressing what it sees as 30-40 TWh of LDES needed in the USA by 2040. Its annual production capacity is 75 MW 800 MWhs. ESS targets lithium-ion for now, promising far better cost, cyclability and life. In 2023 it announced a small order for Amsterdam Airport Schiphol and paired with the first-ever installation of solar panels over irrigation canals in the United States generating clean energy while conserving water resources in an increasingly arid California. 13 GW of solar capacity could be installed over California’s canals, ultimately requiring 3 GW (maybe 30GWh) of energy storage in the dream. For now, ESS iron RFB offers up to 12 hours duration, with splendid environmental credentials. What is the upper limit of viable duration for ESS? Can it compete as the primary grid market shifts to 30-100 days at GWh levels?

Physics will probably win with chemistry making a lot of money as number two with a window of opportunity . There are many attractions in pumped hydro reinvented by flexing rocks underground, pumping heavy rock slurry up mere hills (lots to choose from) and lifting rocks above ground, for instance. Lots of rocks. Maybe we shall progress from the iron age to the stone age. Tell that to your history teacher. Quote Zhar Research report, “Long Duration Energy Storage LDES Markets 2023-2043: Grid Microgrid Delayed Electricity 6 Hours to Seasonal”.

Press release distributed by Pressat on behalf of Zhar Research , on Friday 5 May, 2023. For more information subscribe and follow https://pressat.co.uk/

LDES Energy Electricity Emerging Markets Emerging Technology Technology Microgrids Delayed Electricity Physics Chemistry Business & Finance Computing & Telecoms Education & Human Resources Manufacturing, Engineering & Energy Media & Marketing

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

Long Duration Energy Storage: Physics or Chemistry

News from this source: