Hybrid Energy Storage Becomes Big Business

Delayed electricity is required for backup, to cover intermittency of supply and demand, to smooth fierce inputs and to provide fierce outputs when needed, for example. The basic technologies for this include supercapacitors, conventional batteries and facilities resembling chemical factories. Between the last two are redox flow batteries RFB headed for $22 billion in sales in 2044 according to the analysis in Zhar Research report, “Redox Flow Batteries: 26 Market Forecasts, Roadmaps, Technologies, 48 Manufacturers, Latest Research Pipeline 2024-2044”. Interestingly, most of that will concern beyond-grid such as microgrids, industrial processes and solar buildings capable of disconnection from the grid. Hybrids of the basic design and a battery are involved. RFB attributes are very suitable for these needs but, for mainstream grid storage, battery-less solutions such as pumped hydro and underground compressed air have a stronger position, even though RFB can perform the increasingly necessary Long Duration Energy Storage LDES. That is covered by Zhar Research LDES reports.

Hybrids are more than curiosities

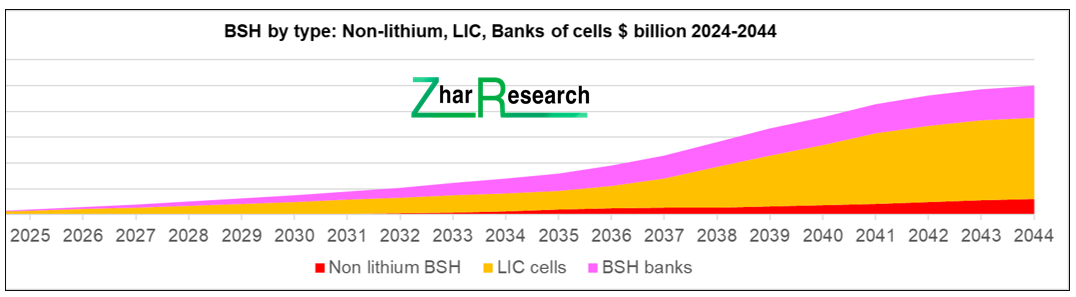

A closer look reveals that even hybrids of supercapacitors, conventional and redox flow batteries are not just curiosities, they are going to outsell some of the core technologies from whence they came. New analysis by Zhar Research shows that Battery Supercapacitor Hybrid BSH, starting with the ones called Lithium-ion Capacitors LIC, will outsell supercapacitors to reach $10 billion in 2044. See Zhar Research report, “Lithium-ion capacitors and other battery supercapacitor hybrid storage: detailed markets, roadmaps, deep technology analysis, manufacturer appraisal, next successes 2024-2044”.

Power and speed

As any karate expert slicing a brick will tell you, the need is both power and speed. Electric equivalents include the new unmanned mining, thermonuclear fusion power and electromagnetic and electrodynamic weapons arriving. The supercapacitor bank often used today in these applications provides the speed and fit-and-forget but its size brings inductive and resistive losses and is inconvenient on vehicles, so there are early signs that lithium-ion capacitors LIC are proving better. Actual examples include the Chinese microgrids, shunting locomotives and mining vehicles, the Japan Tokamak fusion reactor and Toyota fuel cells now using them.

Fit-and-forget is demanded

Academics may point out that cycle life sometimes drops from one million for supercapacitors to 50,000 for LIC but industrialists make the more important point that even the lower figure is almost always longer than the life of the equipment to which the LIC is fitted. In other words, in the real world, it is still effectively infinite life and certainly more than a magnitude better than any battery will achieve. That is why Kurt Energy in Germany has a 150kWh LIC driving a large excavator vehicle for fit-and-forget, reliability and safety beyond a lithium-ion battery. The company SURE in the Netherlands newly uses LIC in its rental e-bikes for greatly improved damage tolerance, life and safety. A huge research pipeline, particularly for 2023 and 2024, that is analysed in the report, shows how replacing the lithium in LIC with any of ten metals or exotica such as metal organic frameworks MOF, zeolite ionic frameworks ZIF and MXenes can variously lead to BSH with lower costs, better performance and uncontrolled disposal facilitating much more widespread deployment.

Outselling supercapacitors and traditional RFB

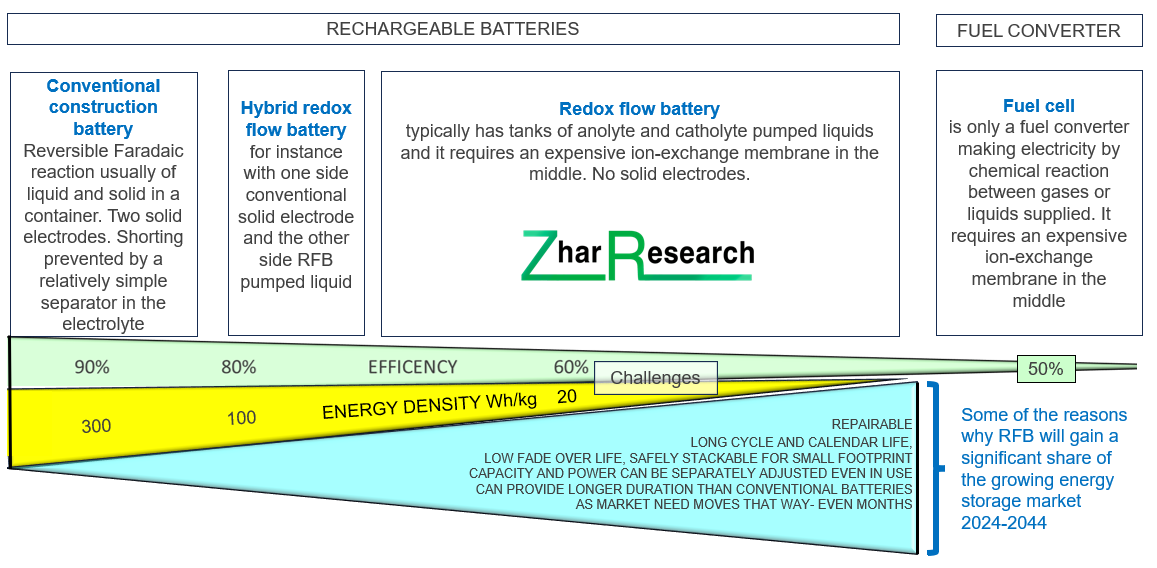

So much for the very important battery supercapacitor hybrids that will outsell supercapacitors. Let us also look at hybrid redox flow batteries that will outsell traditional RFB. This is analysed in Zhar Research report, “Redox Flow Batteries: Market Forecasts, Roadmaps, Technologies, Manufacturers, Research Pipeline 2024-2044”. The traditional RFB has growing markets despite typically using expensive vanadium that must be recovered at end of life. It looks rather like a chemical factory with its large analyte and catholyte tanks and although ones as small as a few kWh are sold, something more compact, lighter weight and simpler is needed without incurring the flammability, thermal management, battery management cost and associated clutter of lithium-ion batteries.

Hybrid RFB taking a large share

Enter the hybrid of RFB and a conventional battery so, for example, there may be only one tank of liquid. The potential improvement is huge, involving around 60% reduction in size, weight and cost compared to vanadium RFB without performance compromises or valuable or toxic materials being involved. Another huge research pipeline progresses these and companies offering iron, iron chromium and other materials in their hybrid RFB are taking substantial orders now. The report finds that RFB will mostly be sold for beyond-grid stationary storage such as industrial processes, solar buildings and microgrids. In 2044, 75% of the $22 billion RFB market will be served by non-vanadium versions that are hybrids such as iron, HBr or HMn-based chemistries.

We have been discussing two different worlds – the BSH mainly managing massive surges in and out and backup and the hybrid RFB mainly providing smoothing and load shifting. Both will sell more into electrical engineering than electronics applications which are still substantial. However, the two hybrids will even compete to some extent. Consider the zero-emission electricity generation that is less intermittent than wind and solar. It is arriving in the form of ocean wave and open-sea tidal power, for instance, where more modest storage is needed, but it needs to be in a form that is zero maintenance, not flammable, very temperature-tolerant and lasts longer than the equipment to which it is fitted. Both BSH and hybrid RFB are candidates for this. Consider solar buildings arriving everywhere, dead at night. Sustainable Energy Technologies Inc offers BSH for solar buildings and Cougar Creek and ESS offer hybrid RFB for the same application currently covered by lithium-ion batteries with inadequate charge retention and life.

Huge opportunities for devices and their value-added materials

The conclusion must be that you ignore hybrid energy storage technologies at your peril, notably BSH and hybrid RFB. You have major opportunities for your added value materials and devices here.

Capacitor supercapacitor hybrids

A smaller but higher profit opportunity is the tantalum capacitor-supercapacitor hybrid CSH, mostly small devices serving the new forms of laser, radar and military electronics needing better ripple tolerance and smaller size and weight than tantalum electrolytic capacitors. See that analysis in the overview Zhar Research report, “Supercapacitor, pseudocapacitor, CSH and BSH hybrid market forecasts in 30 lines, 95 manufacturers appraised, technology roadmaps, next successes 2024-2044”. Find us on www.zharresearch.com and https://www.giiresearch.com.

Press release distributed by Pressat on behalf of Zhar Research , on Thursday 1 February, 2024. For more information subscribe and follow https://pressat.co.uk/

Pseudocapacitors Supercapacitors LIC LDES Hybrid Energy Storage Electric Technology Energy Redox Flow Batteries Computing & Telecoms Consumer Technology Education & Human Resources Manufacturing, Engineering & Energy Opinion Article

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

Hybrid Energy Storage Becomes Big Business

News from this source: