Court Decides Consumers Who Missed The August 2019 Deadline Can Still Claim PPI

This win is extremely significant as it opens the floodgates to new PPI claims

Fast Track Solicitors, Stockton-on-Tees, 9th of July 2020: A landmark ruling renders the PPI deadline irrelevant for many consumers as;

- Floodgates open to consumers to lodge PPI claims after the 2019 deadline

- The Bank’s non-disclosure of commission for the PPI sale is ruled unfair

NatWest Bank will be licking its wounds after losing a court case at Gloucester & Cheltenham on Friday 3rd July 2020 whereby it was held unfair for the Bank to charge secret commission for the sale of Payment Protection Insurance. The judgement in favour of the consumer, Mr Priest, made after the Payment protection claim deadline in August 2019 signifies the PPI claim industry is back - alive and kicking.

Mr Priest had been sold PPI alongside a Credit Card in 1999 by NatWest Bank and registered a claim for PPI before the August 2019 deadline. Mr Priest was offered a partial payment of £1,882 under the Financial Conduct Authorities compensation scheme as NatWest did not agree PPI was mis sold but commission was taken.

Unhappy with this payment Mr Priest instructed Fast Track Solicitors to recover all the PPI and Interest for the unfair conduct of NatWest Bank. In court the Judge awarded Mr Priest a further £2,226 (including costs) as well as the £1,882 previously paid.

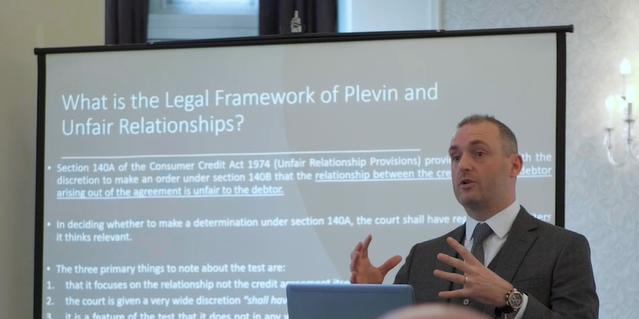

Andrew Settle, Managing Partner of Fast Track Solicitors considers the ruling has a far reaching impact for consumers who have already made a PPI claim and for those who have yet to do so. Mr Settle explains :

“This win is extremely significant as it opens the floodgates to new PPI claims after the deadline in addition to consumers who have not been paid in full as both involve arguments around secret commission. If you consider 99.9% of all PPI agreements involved a secret commission and there is no PPI deadline in court, then this decision is a huge victory for consumers.”

The judge ruled in favour of Mr Priest as he considered the Bank’s commission rate of 77.8% for the sale of PPI was too high and clearly unfair not to be disclosed when the PPI was sold.

Mr Settle continued: “To charge a commission as high as 77.8% of the insurance premium for 20 years and then make a derisory offer of half the amount owed is shocking. Nearly all our cases of this nature don’t see a court room but the ones that do normally result in a full return of all PPI payments plus interest.”

About Fast Track Solicitors

Fast Track Solicitors is a trading style of Joseph James (LS) Limited who are a law firm representing clients who have claims both post and pre the PPI deadline. They have a 100% success rate for all cases taken to trial.

If you have a PPI claim whereby you did not receive the full PPI paid or you missed the deadline go to www.fasttracksolicitors.com

For any press enquiries please contact Andrew Settle, Managing Partner – info@josephjameslaw.co.uk

Press release distributed by Pressat on behalf of Fast Track Solicitors, on Thursday 9 July, 2020. For more information subscribe and follow https://pressat.co.uk/

Ppi Claims Ppi Deadline Fast Track Solicitors Ppi Claim Back Ppi Business & Finance

Published By

0333 212 1112

info@fasttracksolcitors.com

https://www.fasttracksolicitors.com

Andrew Settle, Managing Partner – info@josephjameslaw.co.uk

Telephone: 0203 861 5400

Visit Newsroom

You just read:

Court Decides Consumers Who Missed The August 2019 Deadline Can Still Claim PPI

News from this source: