Battery Grid Storage Will Be Overtaken

“Very large markets for grid LDES are emerging. A twenty-year view is essential."

Grid storage will become a massively larger business due to the rapid adoption of wind and solar power with their intermittency and inability to follow demand. Most is grid storage is currently pumped hydro but with few new ones in the pipeline such as an 8GWh/ 1GW one currently seeking approval in Nevada. There is therefore a rapid rise in lithium-ion battery rapid installations such as the 2GWh/ 0.5GW one in South Africa currently out to tender. The new Zhar Research report, “Long Duration Energy Storage LDES Markets 2023-2043: Grid Microgrid Delayed Electricity 6 Hours to Seasonal” has that analysis of the very different next stage.

After the current frenzy of sales of lithium-ion batteries for grids, it is inevitable that battery-less grid storage will become a much larger business. However, new batteries, not lithium-ion, will have an important secondary place. The primary driver of all this will be the rapidly increasing need for Long Duration Energy Storage LDES for six hours to seasonal delay. Primarily, this will be driven by the percentage of solar power in most grids increasing due to cost and its chronic intermittencies up to seasonal therefore become more impactful on grid service. Wind power can be weak for months.

To the rescue, pumped hydro can delay the most electricity and do it for longer. Unfortunately, that takes forever to approve and install and acceptable steep sites are few. Attempts are being made to reinvent it under water, in mines and - with heavier water - on hills not mountains. For example, underground, a pair of connected 100-hectare reservoirs 20 meters down, with altitude difference 600 meters, can store 24 GWh then supply 1 GW of power for 24 hours, the big new need as grids get to 60% or more of solar or wind/ solar.

The industry is not waiting for that. Enter compressed or liquid air storage for electricity-to-electricity. They neatly serve the increasingly-needed storage of over six hours delay for solar dead at night and even weeks of still, drab days. They are complementary. Call it Long Duration Energy Storage LDES, the required duration of release at full power being similar to, or less than, the required delay but less ambiguous in calculation – just MWh over MW. The longer the delay, the larger the amount of discharge. Therefore increasingly-massive storage is required. The world needs TWh levels of this so a huge new industry is in the making that lithium-ion batteries can never serve. Nails in its coffin for grids include self-leakage, fade (capacity loss over life), toxicity, flammability, poor (expensive) scalability to the increasingly massive sizes needed, life one fifth of emerging competition and Levelised Cost of Storage LCOS ten times too high.

Compressed air energy storage CAES can nicely serve GWh levels where large underground caverns exist or are feasible. Watch Hydrostor. Liquid air LAES is good in space-constrained sites and ones where underground earthworks and attendant delays are undesirable. LAES also attracts for large microgrids as well such as 200MW desalination plants, even off-grid but its LCOS may be too high for mainstream grid LDES. Watch Highview Power. Low risk and proven, both options start with regular compression and cooling technology but Zhar Research expects refinement later. For the considerable emerging demand for new active (powered) cooling technologies see Zhar Research report, “Active Cooling: Large New Materials, Systems Markets 2023-2043”. Meanwhile, the challenges of wind and solar are being approached from both the demand and supply side and magnitude better technologies. Investors will need to pivot during what may be a disruptively short period of change.

Crimp the need for short term storage

One little-mentioned, seismic change in grid storage may occur quite rapidly maybe around 2030. It is collapse of sales of exclusively short term storage - up to six hours delay. This is because we shall crimp the need and long-term storage may also serve what short term storage needs remain. Let us explain.

Many new approaches will crimp the need for that short term storage currently served by a flood of lithium-ion battery orders. They include smart grids, vehicle-to-grid, vehicle-to-house and increased generation from zero-emission renewables with almost no intermittency such as the emerging tidal stream and wave power plus geothermal power reinvented for wider adoption. Indeed, geothermal may double as short-term storage by flexing rocks in current Fervo trials in Nevada. Independently of geothermal, Quidnet Energy proposes flexing rocks as pumped hydro reinvented. Solar will be so cheap that grids will over-install it to create adequate power even at dawn and dusk and give away the resulting surplus electricity at the middle of the day.

One technology for short- and long-term storage

Emerging LDES can often do the short-term storage as well, and at a levelised cost of storage LCOS way below today’s batteries. As we said, solar is winning in generation cost over most of the world but it dribbles one fifth of the power in winter where most of us live. Coming to the rescue are gravity storage lifting blocks can store forever with no self-discharge or fade and, like CAES and LAES, provide at least one hour to 100 days storage – virtually the whole market, with little or no need for separate short-term storage facilities. With repair, all can last 50 years but gravity storage has yet to be proven at scale and it may fail on LCOS or reliability.

A place for batteries as well

There are exceptions for the new batteries to address. A country like Norway with a great deal of hydropower or island nations with considerable wave and tidal power may optimally store electricity for only a few days maximum and therefore use batteries sometimes. New battery chemistries are coming along. Form Energy has raised $650 million and this year Noon Energy has raised $35 million for conventional batteries based respectively on iron and carbon oxidation promising affordable 100-hour grid storage, maybe more. Sodium-ion conventional batteries are already arriving in electric vehicles and solar houses. They may become candidates for replacing grid lithium-ion batteries for grids that do not need longest term storage. Sodium-ion provides lower cost up-front and over life and better temperature range than lithium-ion but questions remain. The redox flow battery RFB has some technological commonality with fuel cells and the electrochemical cooling currently in research, potentially leveraging cost improvement and experience as proponents address its high LCOS. Batteries capable of viably providing days of storage for space-constrained buildings and microgrids will become another excellent market.

Conclusion

Dr Peter Harrop, CEO of Zhar Research sums up,

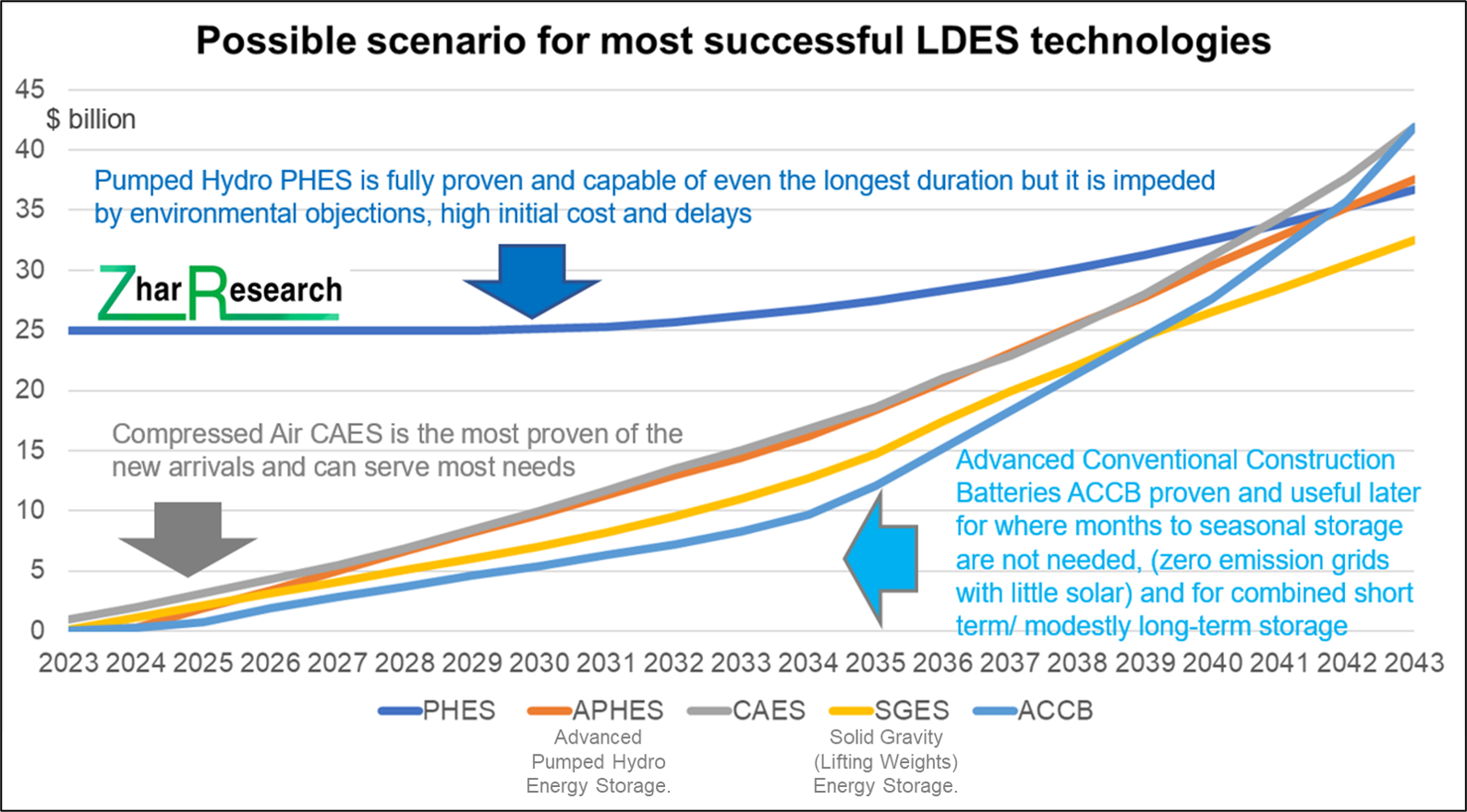

“Very large markets for grid LDES are emerging. A twenty-year view is essential. Forecasts are given in Zhar Research report, “Long Duration Energy Storage LDES Markets 2023-2043: Grid Microgrid Delayed Electricity 6 Hours to Seasonal”. In one scenario, they show that five technologies may be trading at $30-$45 billion levels in 2043 – pumped hydro, reinvented pumped hydro, CAES, advanced conventional construction batteries ACCB and solid gravity energy storage. The need will be far greater. However, most are, as yet, unproven in LCOS and scalability and some of them may not make it. Also in contention are RFB, LAES, fundamentally-more-limited hydrogen storage and certain other technologies. Each of them are more likely to be at a level of $5-$20 billion dollars in 2043 but some may exceed our current expectations depending on improvement of their technologies. As new data arrive, we shall adjust our forecasts. Lithium-ion batteries? Not a chance.”

Press release distributed by Pressat on behalf of Zhar Research , on Tuesday 28 March, 2023. For more information subscribe and follow https://pressat.co.uk/

LDES Long Duration Energy Storage Emerging Market Future Technology Electricity Energy Batteries Energy Grids Battery Grid Lithium-Ion Business & Finance Computing & Telecoms Consumer Technology Manufacturing, Engineering & Energy

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

Battery Grid Storage Will Be Overtaken

News from this source: