Shop Price Deflation: Good News For Christmas Shoppers

News provided by Rocket Pop PR on Tuesday 3rd Dec 2013

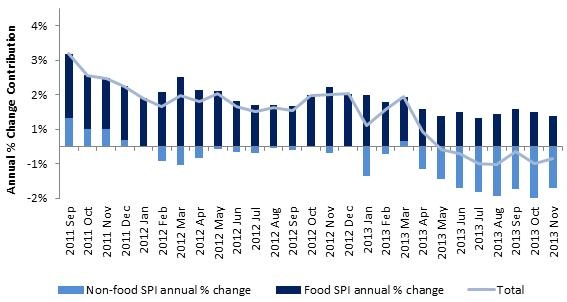

- Overall shop prices reported annual deflation for the seventh consecutive month in November, slowing to 0.3% from the 0.5% decline reported in October.

- Food inflation slowed to 2.3% in November from 2.7% in October.

- Non-food reported annual deflation of 2.0% in November from 2.4% in October.

Helen Dickinson, British Retail Consortium Director General, said:

"The seventh consecutive month of deflation is great news for hard-pressed households as Christmas gets closer, and confirms that retailers are reading current conditions well and matching the mood in their promotions and product offers.

"Food inflation fell to its second lowest level since June 2010, driven mainly by fresh produce, which indicates that there are plenty of good deals to be had as customers start stocking up on seasonal fare. A better global harvest has led to lower commodity prices, particularly for oil, and with few signs of volatility in the system at present I would expect levels to remain fairly stable in the coming months.

"Non-food has been deflationary since March, and November continued the trend, mainly fuelled by promotions in fashion, furniture and electricals. In areas where deflation slowed, it was mainly due to a natural levelling off of some of the early-bird Christmas offers, especially in the books category following 'Super Thursday'.

"There are some encouraging signs in here for anyone starting to make some headway on their Christmas lists."

Mike Watkins, Head of Retailer and Business Insight, Nielsen, said:

"Across most of the industry it`s been a slower than usual start to Christmas trading and we expect retailers to keep promoting to help drive footfall. The good news for consumers is that inflationary pressures are less prevalent this year than in previous years. So with sales momentum now starting to build, we anticipate some good festive deals for the savvy Christmas shopper."

The BRC-Nielsen Shop Price Index reported annual deflation for the seventh consecutive month, down 0.3% in November from a 0.5% fall in October. Food inflation slowed further to 2.3% from 2.7% in October while non-food reported deflation of 2.0%.

Food inflation fell for the second consecutive month and, to its second lowest level since June 2010, as fresh food reported a sharp deceleration in its inflation rate. This was driven by six of the seven sub-categories reporting a slowing in their rates, particularly convenience food and fruit, with the latter moving into deflationary territory. There was very little movement in the ambient food category with the inflation rate remaining unchanged at 2.4%. The latest input price for home produced food, measured by the ONS Producer Price Index, fell to -2.0% in October, its lowest level since April 2009. This suggests that retailers are facing little pressure from their UK suppliers.

The non-food category has reported annual deflation in 22 of the last 23 months and remains significantly down on a year ago. A number of categories remained deflationary as retailers use discounts and promotions to drive sales at the expense of their margins. The average deflation rate in the year to November is 1.4 per cent, considerably higher than the 0.3% decline in the comparable period a year ago. The increased level of discounting has been particularly evident in the clothing and footwear category where deflation has been above 10 per cent for two consecutive months.

The Thomson Reuters Jefferies-CRB index, a weighted commodities benchmark, has fallen by eight per cent since the start of the year and four per cent since the end of October's survey period.

Commodity prices have remained low and stable, driven by better global harvests this year. This is demonstrated in the table below with four key commodities reporting double-digit declines.

The United States Department for Agriculture (USDA) forecasts world wheat production in 2013/2014 down 2.5 million to 706.4 million tons from last month's forecast. The largest change in production came from Russia which cut its projected wheat production and delayed planting due to abnormally cold weather and an excessively wet September and start to October. Records indicate that September 2013 in the Central Belt of Russia had the highest precipitation rate since 1885. It is estimated that 4.4% of the planting area for wheat has been categorised as damaged.

The official measure of inflation, the Consumer Price Index (CPI), fell sharply to 2.2% in October from 2.7% in September, the lowest rate since September 2012, and has not been lower since November 2009. This was driven by a significant fall in transport prices which recorded their biggest drop in over four years. One of the main drivers was competition on the forecourts at many major supermarkets pushing petrol prices lower. Education costs also levelled off.

The latest Inflation report from the Bank of England said that the recovery had "finally taken hold". The Bank upgraded its forecasts for economic growth and unemployment as well as lowering its outlook for inflation compared with its forecasts three months earlier. Near-term inflation in particular is due to be lower before remaining around, or slightly lower than, its two per cent target rate.

At -0.3% the Shop Price Index remains significantly below the official rate of inflation, the CPI. The retail sector continues to support hard-pressed consumers whose real disposable incomes are still being squeezed. The latest data from the Office for National Statistics showed wages grew at just 0.8%, significantly lagging behind inflation.

Barring any shocks to the supply chain, shop prices are expected to remain fairly stable in the medium term.

In November, food inflation slowed for the second consecutive month to 2.3% from 2.7% in October. This is the second lowest level since June 2010.

On a month-on-month basis, prices rose 0.2%, unchanged from October's rate.

Fresh Food

Fresh food inflation fell sharply to 2.3% in November after two consecutive months at 2.9%, the lowest inflation rate since June 2010. Downward pressure came from the fresh fruit category which moved into deflationary territory for the first time in 14 months. The convenience food, oils and fats, milk, cheese and eggs and to a lesser extent the meat and vegetables categories also contributed to the slowing overall rate. Fish was the only category to report a rise in its inflation rate.

On a month-on-month basis prices were broadly flat after rising 0.4% in October.

Ambient Food

Ambient food inflation was unchanged at 2.4% for the second month in a row. There was very little movement within the category in November. Non-alcoholic and alcoholic beverages provided some upward pressure which was cancelled out by slowing inflation in the category containing sugar, jam and chocolate.

On a month-on-month basis prices rose 0.3% in November after being broadly flat in October.

Non-food deflation slowed to 2.0% in November from 2.4% in October. Upward pressure was provided by the books, stationery and home entertainment category which fell back into inflationary territory, while the health and beauty and DIY, gardening and hardware categories reported a slight rise in their inflation rates. All three deflationary sub-categories reported a slowing in their rates in November, however clothing and footwear and electricals remained more deflationary than the overall non-food rate.

On a month-on-month basis prices rose 0.2% in November from a 0.4% fall in October.

Clothing & Footwear

In November, deflation in the clothing and footwear category slowed to 10.1% from 10.7% in October.

All six sub-categories remained in deflationary territory although footwear, men's, women's and children's clothing all reported slowing annual deflation. This outweighed accelerating deflation in the clothing accessories and babywear categories. The onset of the cold weather in recent weeks should have a positive impact on the category with a combination of pent-up demand and gift buying over the festive period easing the pressure on retailers margins which have been hit by the persistently high levels of discounting. Pressure from the price of cotton has eased in recent months. While it still remains 11% higher year-on-year, it has fallen 17% from its recent peak in mid-August 2013.

Furniture & Floorcovering

In November, deflation in the furniture and floorcoverings category slowed to 1.6% from 1.8% in October, the lowest rate for four months. The household textiles category was the sole driver of the slowing overall rate as it moved into inflationary territory. The furniture, furnishings and carpet category reported an acceleration in its deflation rate. The Bank of England reported a further rise in mortgage approvals which climbed to 67,701, the highest level since February 2008, with data from the Nationwide Building Society showing a 6.5 per cent rise in house price inflation, the highest for over three years. The Governor of the Bank of England warned potential home-buyers that they must be able to pay for their mortgages when interest rates begin to rise. Fears of a new housing bubble led to the Bank's Financial Policy Committee restricting the Funding for Lending Scheme for new housing loans, bringing it to an end a year earlier than planned. From 2014 the scheme will only cover boosting loans to businesses.

Prices fell for the second consecutive month, down 0.3% in November from a 0.2% fall in October.

Electricals

Deflation in the electricals category slowed to 3.0% in November from 3.8% in October, the lowest inflation rate since April 2011. This was driven solely by the household appliances category which fell back into inflationary territory after reporting deflation in October. The audio and visual equipment category remained significantly down on a year ago. The latest data from GfK showed a slight fall in the component that measures consumers' willingness to make major purchases, falling to -13 from -11. With the next generation of game consoles now released, retailers are battling for a share of what should be a bumper.

On a month-on-month basis, prices increased 0.2% after a 0.5% fall in October.

DIY, Gardening and Hardware

Inflation in the DIY, gardening and hardware category rose to 1.6% in November from 1.0% in October. The rise was solely driven by the tools and equipment for the house and garden category which reported a sharp rise in its inflation rate. This is a relatively quiet time for the gardening sector, however the recent uplift in the housing market continues to have a positive impact on the DIY and hardware components.

On a month-on-month basis prices rose just 0.1% after they were broadly flat in October.

Books, Stationery and Home Entertainment

The books, stationery and home entertainment category reported annual inflation of 0.4% in November after the 0.5% decline in October. Upward pressure was exerted by the books and newspapers category after a decrease in the level of promotional activity from October's elevated level. The stationery category also provided some upward pressure.

On a month-on-month basis prices were broadly flat after rising 0.2% in October.

Health & Beauty

The health and beauty category reported annual inflation of 1.7% in November from 1.3% in October. Upward pressure came from the personal care and toiletries and cosmetics categories, both of which reported an acceleration in their inflation rates.

On a month-on-month basis, prices rose 0.3% after a 0.6% fall in October.

Other non-food

The other non-food category reported annual inflation of 2.2% in November, unchanged from October's rate.

On a month-on-month basis prices rose 0.1% after they were broadly flat in October.

Methodology

The SPI is administered by Nielsen, who collate and analyse the data on behalf of the BRC.

The index provides an indicator of the direction of price changes in retail outlets. The BRC launched the Shop Price Index to give an accurate picture of the inflation rate of 500 of the most commonly bought high street products in stores.

As the Index is designed to reflect changes in shop prices, the sampling points chosen are five large urban areas, spread nationally. Not all sample stores are in city centres; they have been selected to reflect local shopping habits. Therefore, the sample includes superstores on out-of-town sites, town centre department stores, local parade stores, and shopping centres. In each location, Nielsen collect and process the data for the BRC, visit stores of differing types, e.g. grocery, confectionery, DIY, department stores - including small and large multiples and independents. Data collection is monthly and always in the same stores to maintain consistency.

The items for which prices are collected reflect standard consumer purchasing patterns in terms of branded/own label split and price distribution. The Index is constructed of seven main sectors of purchase: food, DIY, gardening and hardware, furniture, books, stationery and home entertainment, electrical, clothing and footwear, and other non-food. In total there are 500 items representing the seven main sectors, there are around 6,500-7,000 price points collected each period. Each product class category has an individual weighting based on the "All households" expenditure measured in the Family Expenditure Survey. This data is also used to weight the Office for National Statistics Retail Price Index (RPI).

Although it is a proxy measure of inflation, the Shop Price Index is more focused than the Retail Price Index, and demonstrates the extent to which retailers contribute to inflation through their pricing of a range of commonly bought goods.

For more information please contact:

Mandy Ryan, British Retail Consortium

T: 020 7854 8920 / 07557 747 269

E: mandy.ryan@brc.org.uk

- Food inflation slowed to 2.3% in November from 2.7% in October.

- Non-food reported annual deflation of 2.0% in November from 2.4% in October.

Helen Dickinson, British Retail Consortium Director General, said:

"The seventh consecutive month of deflation is great news for hard-pressed households as Christmas gets closer, and confirms that retailers are reading current conditions well and matching the mood in their promotions and product offers.

"Food inflation fell to its second lowest level since June 2010, driven mainly by fresh produce, which indicates that there are plenty of good deals to be had as customers start stocking up on seasonal fare. A better global harvest has led to lower commodity prices, particularly for oil, and with few signs of volatility in the system at present I would expect levels to remain fairly stable in the coming months.

"Non-food has been deflationary since March, and November continued the trend, mainly fuelled by promotions in fashion, furniture and electricals. In areas where deflation slowed, it was mainly due to a natural levelling off of some of the early-bird Christmas offers, especially in the books category following 'Super Thursday'.

"There are some encouraging signs in here for anyone starting to make some headway on their Christmas lists."

Mike Watkins, Head of Retailer and Business Insight, Nielsen, said:

"Across most of the industry it`s been a slower than usual start to Christmas trading and we expect retailers to keep promoting to help drive footfall. The good news for consumers is that inflationary pressures are less prevalent this year than in previous years. So with sales momentum now starting to build, we anticipate some good festive deals for the savvy Christmas shopper."

The BRC-Nielsen Shop Price Index reported annual deflation for the seventh consecutive month, down 0.3% in November from a 0.5% fall in October. Food inflation slowed further to 2.3% from 2.7% in October while non-food reported deflation of 2.0%.

Food inflation fell for the second consecutive month and, to its second lowest level since June 2010, as fresh food reported a sharp deceleration in its inflation rate. This was driven by six of the seven sub-categories reporting a slowing in their rates, particularly convenience food and fruit, with the latter moving into deflationary territory. There was very little movement in the ambient food category with the inflation rate remaining unchanged at 2.4%. The latest input price for home produced food, measured by the ONS Producer Price Index, fell to -2.0% in October, its lowest level since April 2009. This suggests that retailers are facing little pressure from their UK suppliers.

The non-food category has reported annual deflation in 22 of the last 23 months and remains significantly down on a year ago. A number of categories remained deflationary as retailers use discounts and promotions to drive sales at the expense of their margins. The average deflation rate in the year to November is 1.4 per cent, considerably higher than the 0.3% decline in the comparable period a year ago. The increased level of discounting has been particularly evident in the clothing and footwear category where deflation has been above 10 per cent for two consecutive months.

The Thomson Reuters Jefferies-CRB index, a weighted commodities benchmark, has fallen by eight per cent since the start of the year and four per cent since the end of October's survey period.

Commodity prices have remained low and stable, driven by better global harvests this year. This is demonstrated in the table below with four key commodities reporting double-digit declines.

The United States Department for Agriculture (USDA) forecasts world wheat production in 2013/2014 down 2.5 million to 706.4 million tons from last month's forecast. The largest change in production came from Russia which cut its projected wheat production and delayed planting due to abnormally cold weather and an excessively wet September and start to October. Records indicate that September 2013 in the Central Belt of Russia had the highest precipitation rate since 1885. It is estimated that 4.4% of the planting area for wheat has been categorised as damaged.

The official measure of inflation, the Consumer Price Index (CPI), fell sharply to 2.2% in October from 2.7% in September, the lowest rate since September 2012, and has not been lower since November 2009. This was driven by a significant fall in transport prices which recorded their biggest drop in over four years. One of the main drivers was competition on the forecourts at many major supermarkets pushing petrol prices lower. Education costs also levelled off.

The latest Inflation report from the Bank of England said that the recovery had "finally taken hold". The Bank upgraded its forecasts for economic growth and unemployment as well as lowering its outlook for inflation compared with its forecasts three months earlier. Near-term inflation in particular is due to be lower before remaining around, or slightly lower than, its two per cent target rate.

At -0.3% the Shop Price Index remains significantly below the official rate of inflation, the CPI. The retail sector continues to support hard-pressed consumers whose real disposable incomes are still being squeezed. The latest data from the Office for National Statistics showed wages grew at just 0.8%, significantly lagging behind inflation.

Barring any shocks to the supply chain, shop prices are expected to remain fairly stable in the medium term.

In November, food inflation slowed for the second consecutive month to 2.3% from 2.7% in October. This is the second lowest level since June 2010.

On a month-on-month basis, prices rose 0.2%, unchanged from October's rate.

Fresh Food

Fresh food inflation fell sharply to 2.3% in November after two consecutive months at 2.9%, the lowest inflation rate since June 2010. Downward pressure came from the fresh fruit category which moved into deflationary territory for the first time in 14 months. The convenience food, oils and fats, milk, cheese and eggs and to a lesser extent the meat and vegetables categories also contributed to the slowing overall rate. Fish was the only category to report a rise in its inflation rate.

On a month-on-month basis prices were broadly flat after rising 0.4% in October.

Ambient Food

Ambient food inflation was unchanged at 2.4% for the second month in a row. There was very little movement within the category in November. Non-alcoholic and alcoholic beverages provided some upward pressure which was cancelled out by slowing inflation in the category containing sugar, jam and chocolate.

On a month-on-month basis prices rose 0.3% in November after being broadly flat in October.

Non-food deflation slowed to 2.0% in November from 2.4% in October. Upward pressure was provided by the books, stationery and home entertainment category which fell back into inflationary territory, while the health and beauty and DIY, gardening and hardware categories reported a slight rise in their inflation rates. All three deflationary sub-categories reported a slowing in their rates in November, however clothing and footwear and electricals remained more deflationary than the overall non-food rate.

On a month-on-month basis prices rose 0.2% in November from a 0.4% fall in October.

Clothing & Footwear

In November, deflation in the clothing and footwear category slowed to 10.1% from 10.7% in October.

All six sub-categories remained in deflationary territory although footwear, men's, women's and children's clothing all reported slowing annual deflation. This outweighed accelerating deflation in the clothing accessories and babywear categories. The onset of the cold weather in recent weeks should have a positive impact on the category with a combination of pent-up demand and gift buying over the festive period easing the pressure on retailers margins which have been hit by the persistently high levels of discounting. Pressure from the price of cotton has eased in recent months. While it still remains 11% higher year-on-year, it has fallen 17% from its recent peak in mid-August 2013.

Furniture & Floorcovering

In November, deflation in the furniture and floorcoverings category slowed to 1.6% from 1.8% in October, the lowest rate for four months. The household textiles category was the sole driver of the slowing overall rate as it moved into inflationary territory. The furniture, furnishings and carpet category reported an acceleration in its deflation rate. The Bank of England reported a further rise in mortgage approvals which climbed to 67,701, the highest level since February 2008, with data from the Nationwide Building Society showing a 6.5 per cent rise in house price inflation, the highest for over three years. The Governor of the Bank of England warned potential home-buyers that they must be able to pay for their mortgages when interest rates begin to rise. Fears of a new housing bubble led to the Bank's Financial Policy Committee restricting the Funding for Lending Scheme for new housing loans, bringing it to an end a year earlier than planned. From 2014 the scheme will only cover boosting loans to businesses.

Prices fell for the second consecutive month, down 0.3% in November from a 0.2% fall in October.

Electricals

Deflation in the electricals category slowed to 3.0% in November from 3.8% in October, the lowest inflation rate since April 2011. This was driven solely by the household appliances category which fell back into inflationary territory after reporting deflation in October. The audio and visual equipment category remained significantly down on a year ago. The latest data from GfK showed a slight fall in the component that measures consumers' willingness to make major purchases, falling to -13 from -11. With the next generation of game consoles now released, retailers are battling for a share of what should be a bumper.

On a month-on-month basis, prices increased 0.2% after a 0.5% fall in October.

DIY, Gardening and Hardware

Inflation in the DIY, gardening and hardware category rose to 1.6% in November from 1.0% in October. The rise was solely driven by the tools and equipment for the house and garden category which reported a sharp rise in its inflation rate. This is a relatively quiet time for the gardening sector, however the recent uplift in the housing market continues to have a positive impact on the DIY and hardware components.

On a month-on-month basis prices rose just 0.1% after they were broadly flat in October.

Books, Stationery and Home Entertainment

The books, stationery and home entertainment category reported annual inflation of 0.4% in November after the 0.5% decline in October. Upward pressure was exerted by the books and newspapers category after a decrease in the level of promotional activity from October's elevated level. The stationery category also provided some upward pressure.

On a month-on-month basis prices were broadly flat after rising 0.2% in October.

Health & Beauty

The health and beauty category reported annual inflation of 1.7% in November from 1.3% in October. Upward pressure came from the personal care and toiletries and cosmetics categories, both of which reported an acceleration in their inflation rates.

On a month-on-month basis, prices rose 0.3% after a 0.6% fall in October.

Other non-food

The other non-food category reported annual inflation of 2.2% in November, unchanged from October's rate.

On a month-on-month basis prices rose 0.1% after they were broadly flat in October.

Methodology

The SPI is administered by Nielsen, who collate and analyse the data on behalf of the BRC.

The index provides an indicator of the direction of price changes in retail outlets. The BRC launched the Shop Price Index to give an accurate picture of the inflation rate of 500 of the most commonly bought high street products in stores.

As the Index is designed to reflect changes in shop prices, the sampling points chosen are five large urban areas, spread nationally. Not all sample stores are in city centres; they have been selected to reflect local shopping habits. Therefore, the sample includes superstores on out-of-town sites, town centre department stores, local parade stores, and shopping centres. In each location, Nielsen collect and process the data for the BRC, visit stores of differing types, e.g. grocery, confectionery, DIY, department stores - including small and large multiples and independents. Data collection is monthly and always in the same stores to maintain consistency.

The items for which prices are collected reflect standard consumer purchasing patterns in terms of branded/own label split and price distribution. The Index is constructed of seven main sectors of purchase: food, DIY, gardening and hardware, furniture, books, stationery and home entertainment, electrical, clothing and footwear, and other non-food. In total there are 500 items representing the seven main sectors, there are around 6,500-7,000 price points collected each period. Each product class category has an individual weighting based on the "All households" expenditure measured in the Family Expenditure Survey. This data is also used to weight the Office for National Statistics Retail Price Index (RPI).

Although it is a proxy measure of inflation, the Shop Price Index is more focused than the Retail Price Index, and demonstrates the extent to which retailers contribute to inflation through their pricing of a range of commonly bought goods.

For more information please contact:

Mandy Ryan, British Retail Consortium

T: 020 7854 8920 / 07557 747 269

E: mandy.ryan@brc.org.uk

Press release distributed by Pressat on behalf of Rocket Pop PR, on Tuesday 3 December, 2013. For more information subscribe and follow https://pressat.co.uk/

British UK Retail Food Business & Finance

Published By

Rocket Pop PR

rocketpoppr@outlook.com

Jean Matthews

Samantha Jones

Beehive Mill

Jersey Street

Manchester

M4 6AY

rocketpoppr@outlook.com

Jean Matthews

Samantha Jones

Beehive Mill

Jersey Street

Manchester

M4 6AY

Visit Newsroom

You just read:

Shop Price Deflation: Good News For Christmas Shoppers

News from this source: