Savers And Income Investors See High Returns As Banking's 2nd Biggest Product Hits The Blockchain

HEX.com has succeeded in bringing banking’s second most popular product — the time deposit — to the blockchain.

Investors Are Putting Dollars To Work And Yielding High Returns

The purchasing power of the dollar has seen a precipitous decline year after year, but intelligent fund allocation means savings and investment dollars no longer need suffer. 2021 has seen the largest banks in the world—JPMorgan Chase, Bank of America, BNP Paribas, Goldman Sachs et al.—embrace blockchain technology as a new, efficient means of providing advanced solutions. Ranging from digital asset custody to more wide-reaching blockchain strategies, the benefits of integrating blockchain applications among the world’s largest financial institutions are indeed proving to be many. With this technology being endorsed and utilized by the largest and most highly respected financial institutions, now there’s a smarter, better way for savers and investors to put their money to work.

Savers And Investors Level Up

Imagine having a financial product that safely and securely provides a double-digit rate of return on long-term savings. Today over $8 trillion sits in Certificates of Deposit (CDs), also known as Time Deposits, between the United States and China alone. Unfortunately, however, the most competitive rates offered by banks yield less than 2%. This neither serves as an effective store of value nor does it offset the inflation constantly decaying purchasing power.

HEX.com has succeeded in bringing the CD to the blockchain by deploying a fully audited, secure financial product that is safe, easy to use, and outperforms traditional bank CD yields. At time of writing HEX pays an average 40% APY by monetizing the time value of money in a totally new way only possible through the use of blockchain technology; specifically, the smart contract. As awareness of this new financial product spreads, an increasing amount of funds are allocating to HEX—over $3.2 billion at time of writing—and getting paid high interest every day through its time deposit, or staking, product feature.

With strong attention to detail in its conception and product design, HEX has truly remastered the traditional banking CD by giving it several much-needed upgrades. Three of these include: high interest yield that puts dollars to work; being more secure than FDIC insured banks; the removal of middlemen which allows users full and complete access to their funds at all times. Here we take a look at the features of this new financial product and how it is benefitting everyday savers and investors.

Stakes, Stakers, And The Staker Class

HEX.com is the first blockchain Certificate of Deposit, and with a blockchain product comes a few new terms that are useful and easy to understand. Whereas banks use the nomenclature Certificate of Deposit (CD) to describe their financial product that defines a time locked interest bearing account; in HEX a stake is synonymous and defines the same; collectively, all time locked depositors—stakers—in HEX are referred to as The Staker Class. The user—the staker—controls how much and how long they want to commit their stake for. Every active stake in HEX gets paid high interest daily, and at the completion of the stake may be withdrawn in full.

HEX Pays High Interest Every Day

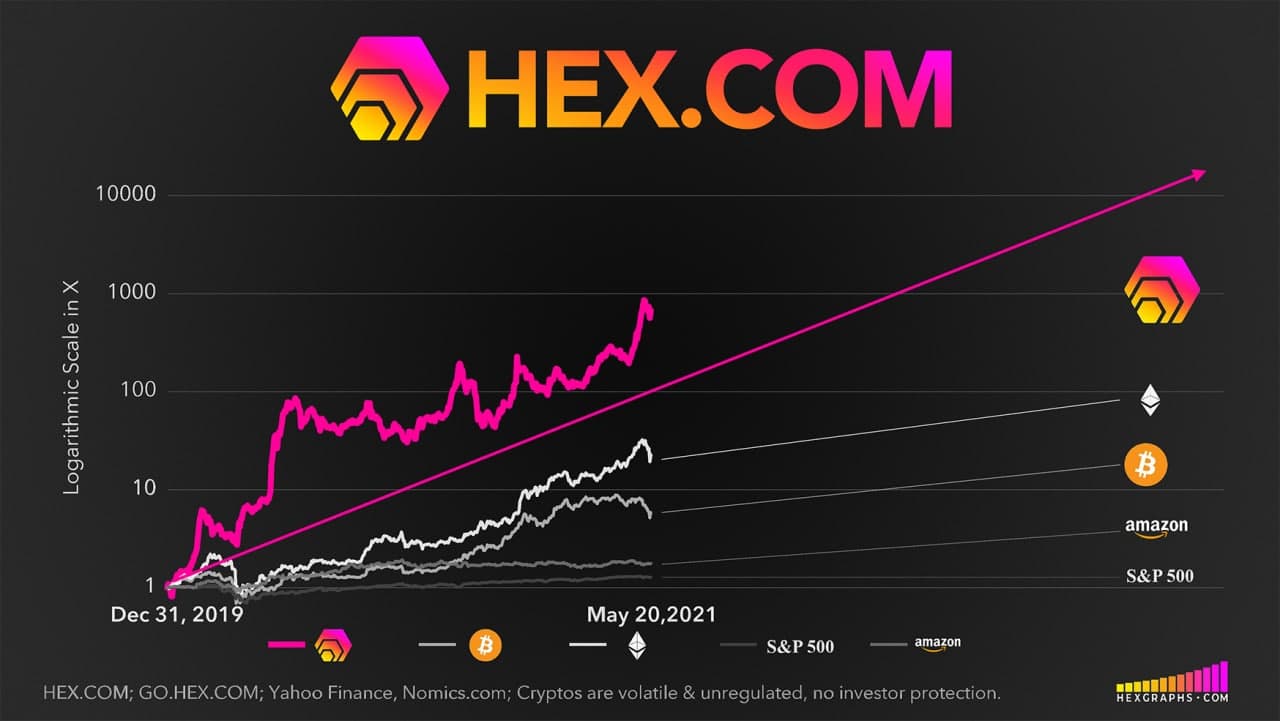

HEX tokens have monetary value and are easily convertible to fiat currency on the blockchain (and vice versa). When HEX tokens are purchased, and then staked, they receive high yielding interest every day paid on top of the token price. The HEX token price has been seen to rise across time due to its growing demand and popularity. In fact, 40% APY aside, the price of the underlying HEX token has outperformed every market since it launched in December, 2019:

Penalties traditional banks would keep for not honoring the terms of the CD—HEX pays directly to The Staker Class. With about 31,000 active stakes at time of writing, this additional bonus for honest stakers adds up fast.

The traditional bank CD worked quite well, so the wheel did not have to be entirely reinvented for HEX; much the same as a bank, HEX rewards users who keep their commitments and also penalizes those who break them (e.g. withdrawing a stake too early or too late). Penalties traditional banks would keep for not honoring the terms of the CD—HEX pays directly to The Staker Class. With about 31,000 active stakes at time of writing, this additional bonus for honest stakers adds up fast. HEX also pays higher rates of interest for committing to stake for longer periods of time just like the bank CD did. More details on the mechanism of HEX’s high interest yield can easily be found exploring HEX.com.

More Secure Than FDIC Insured Banks

In the United States the maximum protection a bank CD can have is from the Federal Deposit Insurance Corporation (FDIC), covering up to $250,000 per depositor, per insured bank, for each account category. The FDIC only protects against a bank failure, however, and the coverage offered has a relatively low limit.

To get security right and completely eliminate the possibility of product failure, HEX underwent 3 separate audits performed by 2 of the top contract auditors in the world specializing in blockchain. The result for HEX has been 100% uptime in a financial product that operates flawlessly. The HEX smart contract is immutable and cannot ever be altered, rendering faith in a bank succeeding, or fear of it failing, irrelevant and immaterial for The Staker Class. The user is fully in control of their funds in HEX, and there is no limit to the balances staking can support.

“HEX was delayed almost a year to get security right, which is why it has 3 Audits; 2 Security Audits, 1 Economics Audit. HEX has no admin keys. No off switch. No pause switch. It’s fully autonomous.

If HEX.com goes offline, I die, the system continues to work fine. It is unstoppable: The code is on the blockchain. You run it. You mint your own rewards. That’s it.”

–Richard Heart, Founder of HEX

100% Uptime And Zero Middlemen

A clear advantage of integrating blockchain technology with personal finance, especially in the case of HEX, is it removes middlemen and the need to trust other people with users' money. Simply stated: math is more trustworthy than man.

The engine for HEX is an immutable smart contract consisting of openly viewable code—a series of mathematical functions—that cannot ever be altered nor impaired. HEX does its magic with no management, no promises, and no expectations of work from others. HEX performs so well solely due to its product design.

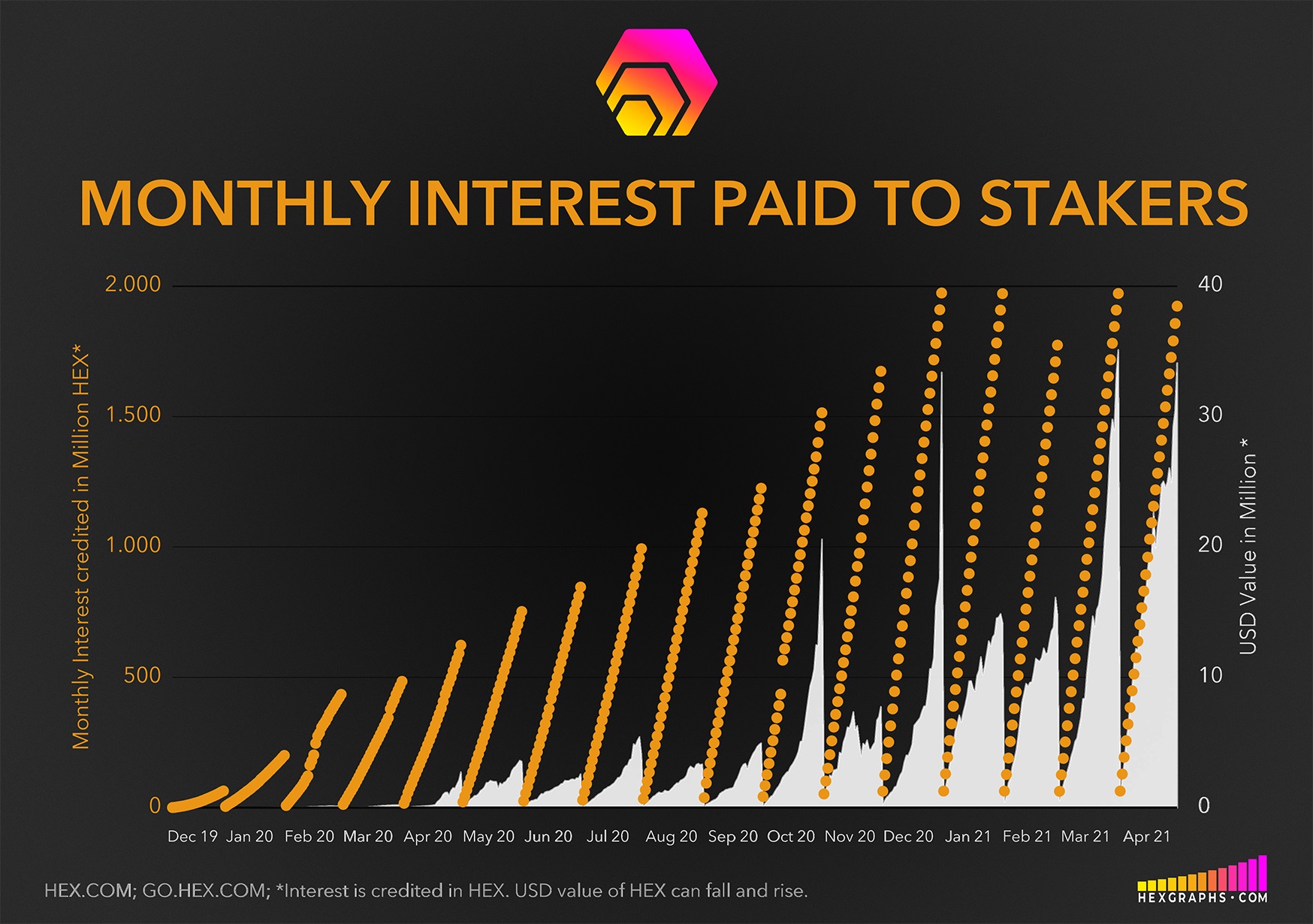

A Trend Of Month-Over-Month Growth

Staking HEX continues to see a trend of month-over-month growth observed in both total active stakes and interest paid. In the past 30 days approximately $17.2 million has been paid to The Staker Class, with about 31,000 active stakes receiving trustless interest paid daily—every day—at 00:00:00 UTC. HEX is a new financial product and the first of its kind, to be sure. The interest (pardon the pun) is picking up momentum, with more users today than ever before.

“Capital goes where it's welcome and stays where it's well treated.” —Former CEO of Citicorp, Walter B. Wriston

So whether one is exploring new ways to sustainably build and increase savings, or simply allocating a portfolio component to produce yield, there is a brand new class of savvy investors reaping consistent, high yielding returns with the blockchain’s first Certificate of Deposit, HEX. As the financial industry continues to embrace and take advantage of blockchain technology for themselves, one thing is certain: HEX’s design and performance continues to benefit savers and investors with outsized returns and an inspiration for their future.

For More Information Visit: HEX.com

News & Updates, Follow on Twitter: @HEXcrypto

Written by Taylor Kennedy

Press release distributed by Pressat on behalf of Hex, on Thursday 20 May, 2021. For more information subscribe and follow https://pressat.co.uk/

HEX Blockchain Crypto Cryptocurrency Banking Dogecoin Bitcoin Ethereum Elon Musk Richard Heart Certificate Of Deposit Investing Business & Finance Computing & Telecoms

You just read:

Savers And Income Investors See High Returns As Banking's 2nd Biggest Product Hits The Blockchain

News from this source: