Pre-Christmas Caution Brings 2.4% Drop In Retail Footfall

News provided by Rocket Pop PR on Monday 21st Oct 2013

Summary:

Footfall in September was 2.4% lower than a year ago, down on the 0.9% fall in August. This compares with particularly strong figures a year ago when footfall rose 0.5% in September 2012.

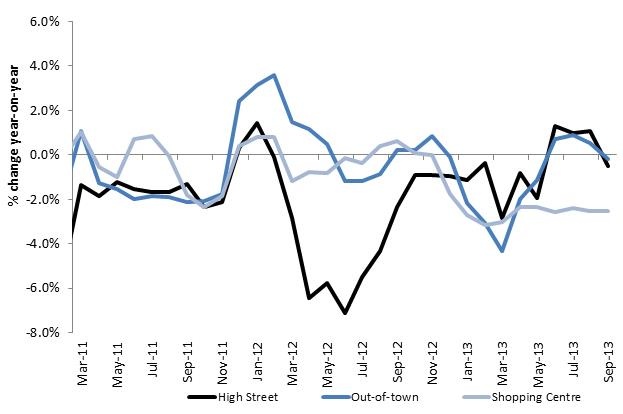

High street footfall was 2.7% lower than a year ago, falling sharply from the 0.6% decline in August. After five months of positive growth, footfall in out-of-town locations fell 1.3%.

Footfall in shopping centre locations fell 2.9% compared with a year earlier, the twelfth consecutive month to report a decline in footfall.

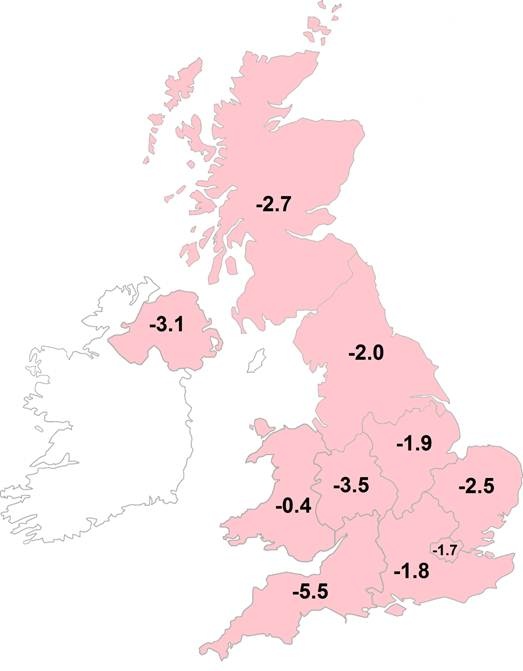

All regions and nations reported a decline in footfall in September. The West Midlands and the South West were hardest-hit with footfall falling 3.5% and 5.5% respectively.

Helen Dickinson, British Retail Consortium Director General, said: "Negative numbers across the UK are clearly a concern this close to Christmas, but there are a few factors at play.

"We're comparing against a very strong September in 2012, when the post-Olympic period coupled with a cold snap unleashed pent-up demand for shopping trips to stock up on warmer clothing and back-to-school items. In contrast, this year's milder September has slowed the uptake of Autumn ranges, a trend reflected in our sales figures last week.

"The sense of tentative optimism is continuing to take hold in the wider economy, but many of us remain cautious and keen to manage our budgets in the run-up to the festive season. Retailers will continue to monitor the mood and respond to customer demand accordingly as they prepare for the all-important countdown to Christmas."

Diane Wehrle, Retail Insights Director at Springboard, said: "Unlike previous months this year, the 2.4 per cent overall decline in footfall recorded in September was a consequence of a drop in customer activity in all three retail environments. Out-of-town was the best performing location type in terms of footfall, which is unsurprising given the fact that the positive sales recorded for September were driven by electrical and leisure goods, and that in-store clothing and footwear sales - the backbone of high street and shopping centre locations - declined over the year.

"The drop in footfall this September was greater than in September 2012 in all three location types, but the greatest fall has occurred in shopping centres - moving from an increase of 1.8 per cent in 2012 to a decrease of 2.9 per cent this year - which clearly highlights the challenges that malls are currently facing in retaining customer numbers.

"Footfall generally declines over the month from August to September in high streets and shopping centres, as spending tails off with the end of the holiday and back to school periods. However, this year the 5 per cent drop in footfall in high streets and 2.1 per cent drop in footfall in shopping centres from August to September was more significant than in previous years, particularly for high streets, which has inevitably adversely impacted the rate of change over the year."

Country and Region Footfall Analysis

Four regions in England reported footfall above the UK average - Greater London (-1.7%), the South East (-1.8%), the East Midlands (-1.9%) and North & Yorkshire (-2.0%).

Wales reported footfall significantly above the UK average although it fell 0.4%. Footfall in Northern Ireland fell back in September to -3.1% after a 1.5% decline in August. Scotland reported a significant drop in footfall, down 2.7%, the lowest rate since March 2013.

- Ends -

Notes to Editors:

Footfall Measure:

The BRC/Springboard Retail Footfall Monitor gathers data on customer activity in town and city centre locations, and in out of town shopping locations, throughout the UK using the latest generation automated technology. The Monitor records over 60 million footfall counts per week at over 600 counting locations in 227 different shopping sites in 142 towns and cities across England, Northern Ireland, Scotland and Wales. The Monitor covers the main centres in each nation/region and a representative sample of secondary and smaller town centres.

We only have data available for the regions covered in this release.

The Monitor provides the only available broad-based measures of the footfall performance of town centre and out of town shopping locations in the UK.

*Starting with the Monitor published in November 2012, figures are weighted by an estimate of footfall by channel (high streets, out of town and shopping centres).

*Starting with December 2012, the country and region figures are also weighted by channel. Previous regional data is for the high street only.

Vacancy Rates:

Springboard gathers vacancy rates in towns and cities via an online survey of town centre managers in 450 locations throughout the UK. The vacancy rate is defined as the percentage of the ground floor units in the town centre that are vacant, and a vacant unit is regarded as one which is not trading at the time of the survey (whether or not it is let). The latest survey was carried out in April 2013.

Starting with the Monitor published in November 2012, vacancy rate figures are weighted by an estimate of regional retail sales.

For more information please contact:

Mandy Ryan

Senior Press Officer, British Retail Consortium

T: 020 7854 8920

M: 07557 747 269

E: mandy.ryan@brc.org.uk

http://www.brc.org.uk

Footfall in September was 2.4% lower than a year ago, down on the 0.9% fall in August. This compares with particularly strong figures a year ago when footfall rose 0.5% in September 2012.

High street footfall was 2.7% lower than a year ago, falling sharply from the 0.6% decline in August. After five months of positive growth, footfall in out-of-town locations fell 1.3%.

Footfall in shopping centre locations fell 2.9% compared with a year earlier, the twelfth consecutive month to report a decline in footfall.

All regions and nations reported a decline in footfall in September. The West Midlands and the South West were hardest-hit with footfall falling 3.5% and 5.5% respectively.

Helen Dickinson, British Retail Consortium Director General, said: "Negative numbers across the UK are clearly a concern this close to Christmas, but there are a few factors at play.

"We're comparing against a very strong September in 2012, when the post-Olympic period coupled with a cold snap unleashed pent-up demand for shopping trips to stock up on warmer clothing and back-to-school items. In contrast, this year's milder September has slowed the uptake of Autumn ranges, a trend reflected in our sales figures last week.

"The sense of tentative optimism is continuing to take hold in the wider economy, but many of us remain cautious and keen to manage our budgets in the run-up to the festive season. Retailers will continue to monitor the mood and respond to customer demand accordingly as they prepare for the all-important countdown to Christmas."

Diane Wehrle, Retail Insights Director at Springboard, said: "Unlike previous months this year, the 2.4 per cent overall decline in footfall recorded in September was a consequence of a drop in customer activity in all three retail environments. Out-of-town was the best performing location type in terms of footfall, which is unsurprising given the fact that the positive sales recorded for September were driven by electrical and leisure goods, and that in-store clothing and footwear sales - the backbone of high street and shopping centre locations - declined over the year.

"The drop in footfall this September was greater than in September 2012 in all three location types, but the greatest fall has occurred in shopping centres - moving from an increase of 1.8 per cent in 2012 to a decrease of 2.9 per cent this year - which clearly highlights the challenges that malls are currently facing in retaining customer numbers.

"Footfall generally declines over the month from August to September in high streets and shopping centres, as spending tails off with the end of the holiday and back to school periods. However, this year the 5 per cent drop in footfall in high streets and 2.1 per cent drop in footfall in shopping centres from August to September was more significant than in previous years, particularly for high streets, which has inevitably adversely impacted the rate of change over the year."

Country and Region Footfall Analysis

Four regions in England reported footfall above the UK average - Greater London (-1.7%), the South East (-1.8%), the East Midlands (-1.9%) and North & Yorkshire (-2.0%).

Wales reported footfall significantly above the UK average although it fell 0.4%. Footfall in Northern Ireland fell back in September to -3.1% after a 1.5% decline in August. Scotland reported a significant drop in footfall, down 2.7%, the lowest rate since March 2013.

- Ends -

Notes to Editors:

Footfall Measure:

The BRC/Springboard Retail Footfall Monitor gathers data on customer activity in town and city centre locations, and in out of town shopping locations, throughout the UK using the latest generation automated technology. The Monitor records over 60 million footfall counts per week at over 600 counting locations in 227 different shopping sites in 142 towns and cities across England, Northern Ireland, Scotland and Wales. The Monitor covers the main centres in each nation/region and a representative sample of secondary and smaller town centres.

We only have data available for the regions covered in this release.

The Monitor provides the only available broad-based measures of the footfall performance of town centre and out of town shopping locations in the UK.

*Starting with the Monitor published in November 2012, figures are weighted by an estimate of footfall by channel (high streets, out of town and shopping centres).

*Starting with December 2012, the country and region figures are also weighted by channel. Previous regional data is for the high street only.

Vacancy Rates:

Springboard gathers vacancy rates in towns and cities via an online survey of town centre managers in 450 locations throughout the UK. The vacancy rate is defined as the percentage of the ground floor units in the town centre that are vacant, and a vacant unit is regarded as one which is not trading at the time of the survey (whether or not it is let). The latest survey was carried out in April 2013.

Starting with the Monitor published in November 2012, vacancy rate figures are weighted by an estimate of regional retail sales.

For more information please contact:

Mandy Ryan

Senior Press Officer, British Retail Consortium

T: 020 7854 8920

M: 07557 747 269

E: mandy.ryan@brc.org.uk

http://www.brc.org.uk

Press release distributed by Pressat on behalf of Rocket Pop PR, on Monday 21 October, 2013. For more information subscribe and follow https://pressat.co.uk/

Retail Foot Fall Money Christmas Business & Finance Retail & Fashion

Published By

Rocket Pop PR

rocketpoppr@outlook.com

Jean Matthews

Samantha Jones

Beehive Mill

Jersey Street

Manchester

M4 6AY

rocketpoppr@outlook.com

Jean Matthews

Samantha Jones

Beehive Mill

Jersey Street

Manchester

M4 6AY

Visit Newsroom

You just read:

Pre-Christmas Caution Brings 2.4% Drop In Retail Footfall

News from this source: