How Bitcoin Futures Trading Platforms Adjust Their Instruments Amidst Bullish Market: Case of Huobi

TEXT: In 2020, crypto derivatives trading replaced spot trading as the most popular digital assets exchange segment. To meet the increased requirements of sophisticated and retail traders, Huobi Futures - the derivatives arm of Huobi Global crypto exchange ecosystem - introduces new instruments.

Huobi Futures meets bullish run locked and loaded: novelties and adjustments

Launched in December 2018, Huobi Futures is a crypto derivatives ecosystem of Huobi Global, one of the oldest digital assets exchanges. Huobi Futures delivers the services of contracts and options trading on multiple currencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Huobi Token (HT), Filecoin (FIL) and so on.

To guarantee all customers an advanced level of trading experience, Huobi Futures introduces daily settlements and stop-loss/take-profit instruments.

Daily Settlements

Starting from Jan. 7, 2021 (GMT+8), Huobi Futures implements daily settlements for coin-margined futures. This option allows traders to build a much more flexible strategy since they can withdraw realized profits promptly after daily settlement at 16:00.

Therefore, there is no need to wait for Friday: trading strategies can be adjusted daily and clients can spend money more effectively.

Types of contract (expiration period) |

Conditions before adjustment |

Conditions after adjustment |

Weekly |

Delivered at 16:00 (GMT+8) every Friday |

Delivered at 16:00 (GMT+8) every Friday; settled at 16:00 (GMT+8) every day except for Friday. |

Bi-weekly |

Settled at 16:00 (GMT+8) every Friday |

Settled at 16:00 (GMT+8) every day |

Quarterly |

Settled at 16:00 (GMT+8) every Friday |

Settled at 16:00 (GMT+8) every day |

Bi-quarterly |

Settled at 16:00 (GMT+8) every Friday |

Settled at 16:00 (GMT+8) every day |

TABLE: Huobi

Initially, the service is offered on a trial basis until June 30, 2021 (GMT+8).

Stop-Losses and Take-Profits

Major risk management instruments - namely, stop-losses and take-profits - should be referred to as the position-closing orders with preset trigger conditions (trigger price of take-profit or stop-loss order) and price.

Setting stop-losses and take-profits eliminates the need for traders to control price moves manually and place ordinary market buy/sell orders.

Rationale

To allow traders to get the most out of a fluctuating market during the bullish rally, Huobi Futures implements stop-losses and take-profits features for coin-margined futures, coin-margined swaps and USDT-margined swaps in the web interface and API version of the trading engine.

New instruments have been available since Jan. 7, 2021 (GMT+8).

How do SL and TP work on Huobi Futures?

Stop-losses and take-profits can be settled for both existing and new positions. Users can set a take-profit order or stop-loss order for a certain position, or set them both at the same time.

To illustrate the way that stop-losses and take-profits work, Huobi Futures summarized examples of the behavior of new and existing positions with these instruments activated.

Set a take-profit and stop-loss order when opening a position |

||

Take-profit and stop-loss order |

Open Long (Buy) |

Open Short (Sell) |

(Close position)Take-profit order |

Price of limit order<Tigger price of take-profit order |

Price of limit order>Trigger price of take-profit order |

(Close position)Stop-loss order |

Price of limit order>Trigger price of stop-loss price |

Price of limit order<Trigger price of stop-loss order |

Set a take-profit and stop-loss order for an existing position |

||

Take-profit and stop-loss order |

Long positions held |

Short positions held |

(Close position)Take-profit order |

Latest price<Trigger price of take-profit order |

Latest price>Trigger price of take-profit order |

(Close position)Stop-loss order |

Latest price>Trigger price of stop-loss order |

Latest price<Trigger price of stop-loss order |

Both types of orders work for closing positions only. Once the position opening (limit) order is fully or partially filled, corresponding stop-loss and take-profits orders go to " placed" status.

Simultaneously placed take-profit and stop-loss orders are interrelated: once the first one is triggered, another is canceled immediately.

How to set stop-losses and take-profits

Stop-losses and take-profits can be placed for existing and new positions, so risk adjustment can be done simultaneously with the opening of trade or after it.

How to set stop-losses and take-profits for a new position

Trader Alice treats 17,000 USDT as a reliable level of support amidst a falling Bitcoin (BTC) price. Meanwhile, a brutal correction may follow if bears manage to suppress BTC below 16,800 USDT. But the 18,000 USDT level is most likely the closest resistance, so it would be interesting to take profits at this level.

As a result, Alice decides to enter the trade at 17,000 USDT, set the stop-loss at 16,800 USDT and the take-profit at 18,000 USDT.

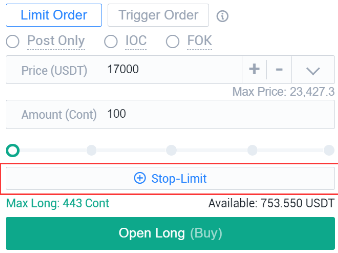

To realize this strategy, she needs to set one limit order, SL and TP. Thus, she needs to choose "Limit order" - "Stop-limit" options and customize the order conditions:

Image: Huobi

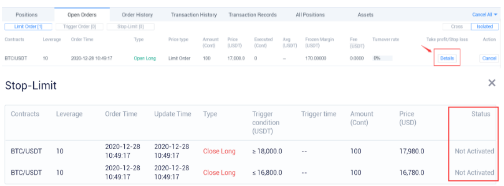

Once the order is set, Alice needs to push "Open Long (Buy)" to make it active. The status of stop-losses and take-profits can be checked in the "Open Orders-Limit Orders" menu.

Once one order is triggered by price moves (either SL or TP, whichever comes first), another one becomes invalid automatically.

How to set stop-losses and take-profits for an opened position

Setting SL and TP for a position that is already opened looks slightly easier. If trader Bob is in a long position from 17,000 USDT/BTC and the price of the king coin inches closer to 18,000 USDT, he may be ready to take profits. He can do it in two ways: by USDT-denominated price and by profit rate.

Choosing the "By Price" method, Tom is able to set 18,500 USDT as a "take-profit" price and 17,500 USDT as a "stop-loss" price. Once two orders are active, they act similarly to Alice’s.

Also, Bob can choose the "By profit rate" mode and decide which profit would be sufficient for his long in this particular market situation.

Bottom Line

Bitcoin Futures should be referred to as speculative contracts that provide traders with exposure to crypto markets without buying tokens directly. Huobi Futures is a reliable vendor of Bitcoin (BTC) futures trading services.

To ensure maximum trading efficiency, its team introduced daily settlement of futures (instead of weekly), as well as stop-loss and take-profit instruments for coin-margined and USDT-margined positions.

Trade on Huobi Futures: futures.huobi.be

Twitter: https://twitter.com/HuobiFutures_

Telegram Chat: https://t.me/HuobiFutures_en

Press release distributed by Pressat on behalf of Huobi Group, on Wednesday 13 January, 2021. For more information subscribe and follow https://pressat.co.uk/

Crypto Currency

Published By

+44 07851039462

jiahailan@huobi.com

https://www.huobi.com/en-us/

Hailan Jia PR Manager of Huobi Group: jiahailan@huobi.com

Visit Newsroom

You just read:

How Bitcoin Futures Trading Platforms Adjust Their Instruments Amidst Bullish Market: Case of Huobi

News from this source: