Helping young people to make sound financial decisions

I didn't have a good understanding about money and budgeting beforehand, but now I know to prioritise my expenses and set a budget for myself

An innovative programme is teaching young people across West Cumbria financial know-how to help them manage their money and stay out of debt.

Citizens Advice Allerdale, Citizens Advice Copeland, and Whitehaven, Egremont & District Credit Union deliver workshops and training sessions to young people aged 11 to 18, covering topics including managing debt, ways to save and banking basics.

The initiative is part of the Financial Wellbeing programme, a strand of Transforming West Cumbria, funded through the Sellafield Ltd Social impact multiplied (SiX) programme and delivered by Cumbria Community Foundation.

Citizens Advice Allerdale and Citizens Advice Copeland offer six free Financial Wellbeing sessions to young people in Years 10 to 13 at schools and colleges in West Cumbria, which aim to provide them with the knowledge, skills and confidence to make good financial decisions throughout their lives.

Shelley Hewitson, Chief Officer at Citizens Advice Copeland, explained: “Financial wellbeing is defined as the feeling of being secure and in control, being able to pay the bills today, having capacity to deal with the unexpected, and being on track for a healthy financial future.”

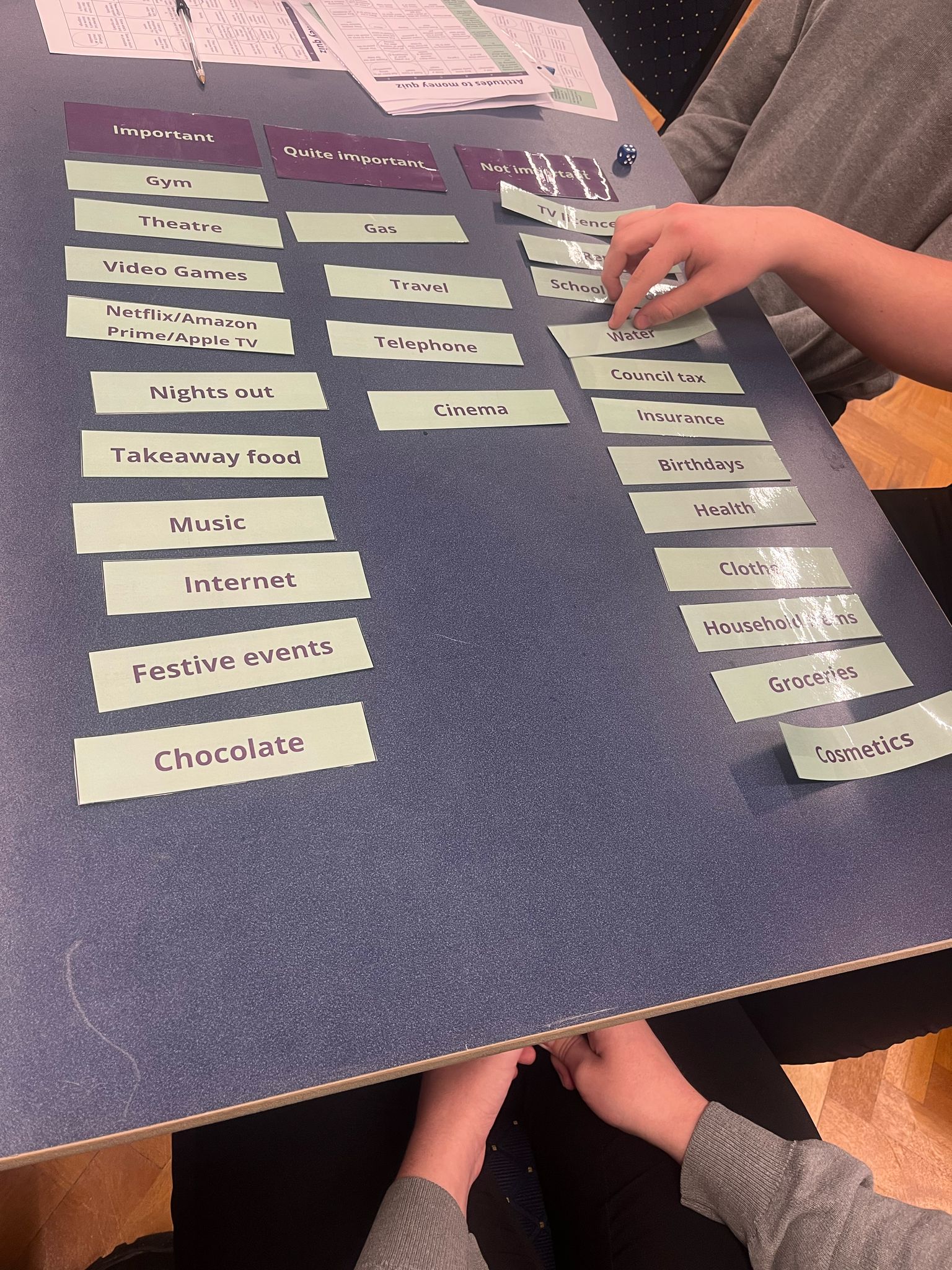

Tara Edwards, Chief Officer at Citizens Advice Allerdale, said: “The sessions we offer provide an introduction to topics which we believe are fundamental to helping young people achieve financial wellbeing – budgeting, debt, credit, savings, banking, employment and starting a job. We use a mix of quizzes, tasks, games and hands-on practice to keep the sessions fun and informative.”

The sessions have been very well received by young people in West Cumbria, with 98% of those attending the budgeting sessions saying they would recommend them to someone of their own age.

One young person said: “I didn't have a good understanding about money and budgeting beforehand, but now I know to prioritise my expenses and set a budget for myself.”

Another said: “It taught me life skills that will be relevant in the future. It shows the need to save so you don't end up in financial issues and complications.”

Online resources are also available, including information for those moving to university or starting an apprenticeship, at https://citizensadvicecopeland.org.uk/index.php/life-skills/.

Whitehaven, Egremont & District Credit Union run workshops focussing on why managing our income and expenditure is so important.

Development Manager Nikki Bates said: “We explain how to identify and prevent problems with your spending and where to go for help and advice.

“Our project is aimed at Year 10 students but it has been delivered to children from ages 11 to 18.”

Schools who have taken part in the Financial Wellbeing programme so far include St Benedict’s School in Whitehaven, Solway School, Beacon Hill School, Energy Coast UTC and Mayfield School. There have also been sessions for apprentices at Sellafield and community youth groups.

The Credit Union and Citizens Advice also ran a specially tailored joint session for young people at Cumbria Academy for Autism.

The Financial Wellbeing programme was launched in 2020 as part of Transforming West Cumbria, aiming to break the cycle of debt for West Cumbrians on low incomes. As well as the sessions in schools and colleges, the programme funds financial wellbeing officers who provide one-to-one financial health checks and information to empower people to take control of their own finances and stop them reaching crisis point.

Eirini Etoimou, Head of Corporate Sustainability & Supply Chain Development at Sellafield Ltd, said: “Transforming West Cumbria aims to tackle the causes of inequality in our most vulnerable communities and bring about lasting change. We know that many people in West Cumbria on low incomes find themselves trapped in a cycle of debt with seemingly no way out. The Financial Wellbeing programme funds work across the community to break this cycle.

“By funding work in schools and colleges to teach young people key money management skills, we are providing them with the knowledge and confidence to make sound financial decisions, which will help them throughout their lives.”

Dr Jenny Benson, Director of Programmes and Partnerships at Cumbria Community Foundation, said: “We see every week the difficulties many people in West Cumbria face managing their household finances, especially in the face of rising costs and increased pressures since the cost of living crisis. This in turn can sadly often lead to anxiety and other mental health challenges.

“We are really pleased to deliver the Financial Wellbeing programme with our partner organisations, particularly the work in schools and colleges, which is equipping young people with the skills and knowledge they will need throughout life to manage their money, stay out of debt and stay well.”

Citizens Advice Allerdale and Citizens Advice Copeland both other free and independent specialist advice across a range of subjects.

Financial wellbeing support, including ways to cut down on your bills and increase your income, plus budget planners, is available at https://citizensadviceallerdale.org.uk/get-advice/financial-wellbeing/cutting-down-on-bills/

Information for people of all ages needing support with problem debt is available at https://citizensadvicecopeland.org.uk/index.php/debt-and-money/

Press release distributed by Pressat on behalf of Cumbria Community Foundation, on Tuesday 8 April, 2025. For more information subscribe and follow https://pressat.co.uk/

Finance Money Financial Wellbeing Children Young People Citizens Advice Credit Union Community Foundation Sellafield Business & Finance Children & Teenagers Personal Finance

Published By

01900825760

annalee@cumbriafoundation.org

https://www.cumbriafoundation.org

Visit Newsroom

You just read:

Helping young people to make sound financial decisions

News from this source: