Break the taboo - New free family money skills app

Behaviours towards money start to form at age seven

A new free app to help UK families learn to save, budget and spend wisely has been launched by the charity MyBnk and technology consultancy Capco Digital.

Just 48% of children and young people receive key elements of financial education at home or school and key attitudes and behaviours towards money start to form at age seven, according to the Money and Pensions Service.

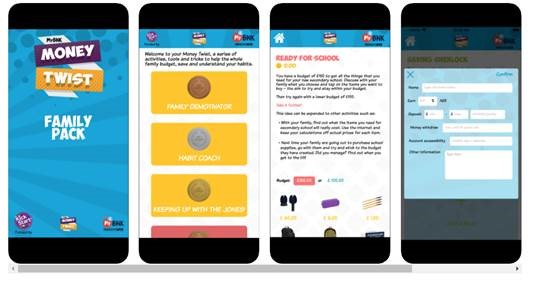

Led by parents, but involving the whole family, Money Twist features a range of fun and accessible games and activities aimed at 5-11 year olds that brings personal finance to the breakfast table.

Our financial education experts have created nine pathways that teach young people the value of money and improve family money skills and habits through videos, virtual shopping, back-to-school tasks, storytelling and ‘demotivators’ that highlights excessive spending.

Covering topics such as interest, debt, risk and banking, the app helps families work together to enhance their understanding around personal finance and encourage a positive mindset.

The app is part of our flagship schools programme, funded by Kickstart Money, an alliance of the UK’s biggest investment funds campaigning for compulsory money lessons in primary schools. Our programmes have been independently evaluated with the Money and Pensions Service and proven to improve savings, reduce debts and curb spending.

Money Twist activities include:

- Keeping up with the Jones – Distraction tactics and money mantras.

- Habit Coach – A weekly family chart to track spending patterns.

- Family Demotivator – See how a small habit can add up BIG time.

- Money Mad Fibs – A story builder to identify how money makes you feel and envision your own financial future.

- Ready for School – Create your own back-to-school budget using £150.

- Weekly Shop – Build your shopping list using a pre-set budget.

- 60 Second story – Role play are a big/savvy spender or a super saver using key financial terminology.

- Time Jump - Help your younger self avoid temptation.

- Savings Sherlock - Keep track of banking activity.

Download Money Twist now via the App Store and let us know how you got on!

Quotes

Guy Rigden, CEO, MyBnk, said: “We believe that to properly manage your money, you need to start learning about it from an early age to make positive choices in the future. Families are the most important messengers in children’s lives but money is often a taboo subject. This app helps develop the healthy attitudes and behaviours that lay the foundation for future financial capability.”

Mike Ethelston, UK Managing Partner, Capco, said: “In developing this new app, our Digital team has applied the latest digital thinking and technologies to help young people and their families better understand the cost of living and budget more effectively day-to-day. As a firm that employs a young and diverse workforce, this project really struck a chord within Capco and we are delighted to have played a part in furthering the cause of financial education and inclusion in the UK.”

Press release distributed by Pressat on behalf of MyBnk, on Thursday 13 February, 2020. For more information subscribe and follow https://pressat.co.uk/

Money Personal Finance Family Parents Financial Education Apps Technology Children Young People Education Financial Literacy Saving Debt Business & Finance Children & Teenagers Computing & Telecoms Education & Human Resources Lifestyle & Relationships Personal Finance

You just read:

Break the taboo - New free family money skills app

News from this source: