Automotive companies at the crossroads: Turning software-defined vehicles from hype to value driver

- Transition from "hype" to implementation phase poses challenges for established industry players.

- Automotive software market to grow to $118 billion by 2030 but falls short of industry expectations.

- EY estimates that the average investment required per OEM for SDV programs will be between one and five billion U.S. dollars.

- The identification of future market dynamics and potentials as well as the optimization of necessary key competences (e.g., partnerships, coopetition) is crucial.

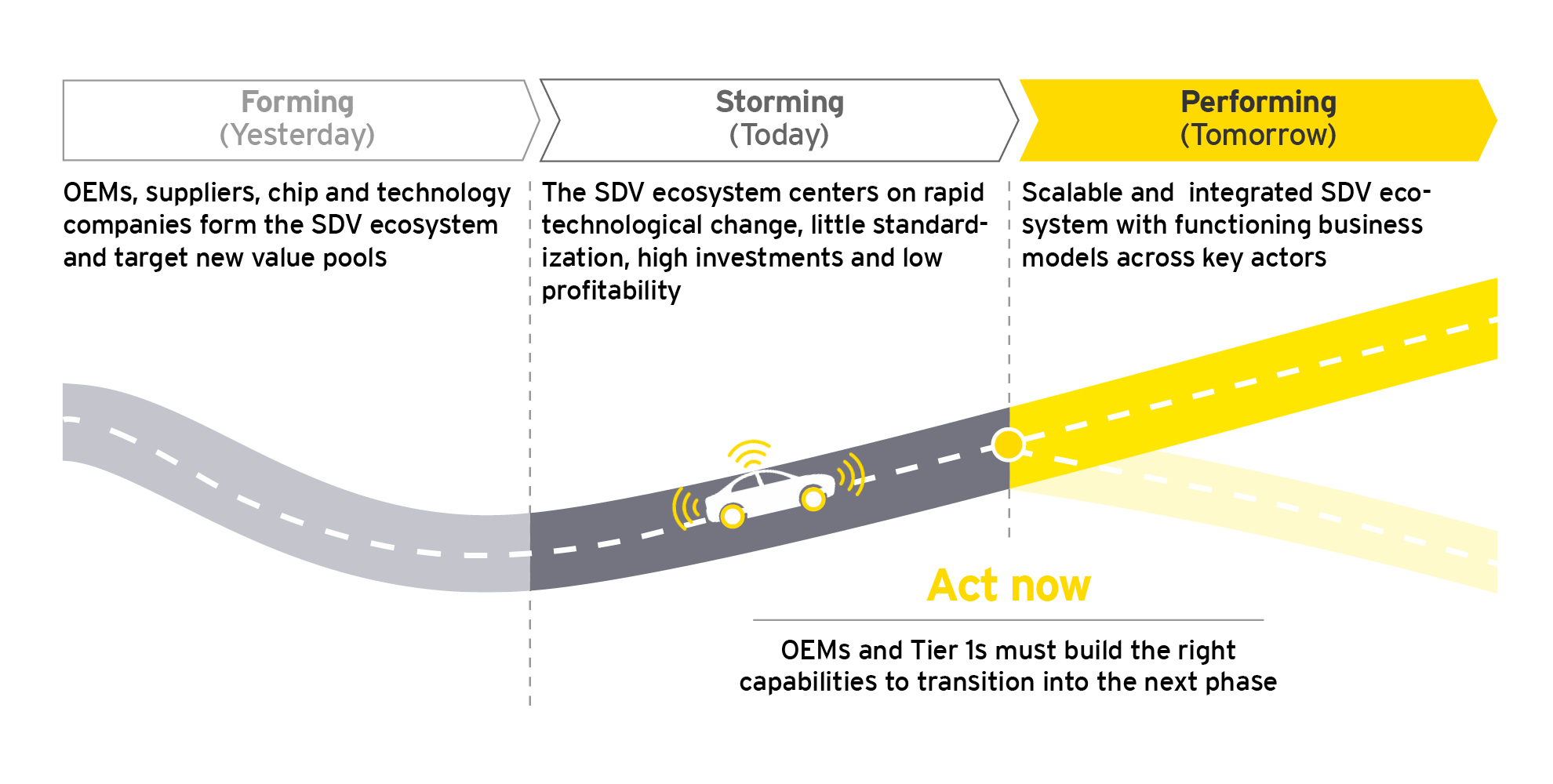

Stuttgart, Germany, September 12, 2023 - The more established automotive manufacturers and suppliers are at a crucial turning point in the much-discussed software transformation: the time for experimenting with new technologies, partnerships and business models is over, and full concentration on the commercialization of the Software Defined Vehicle (SDV) is the top priority. The next phase of the transformation will determine whether OEMs and traditional suppliers can make the leap to "automotive software company" and maintain their central role, or whether they will have to leave the field to the large technology groups and the new, digitally native automakers from China or the U.S., according to a study by EY published on Monday on the occasion of the IAA Mobility in Munich, Germany.

Increased customer demand for integrated software solutions has the potential to virtually disrupt the existing structures of the automotive sector, the study says.

"The automotive industry is at a crossroads. After the hype phase, it is now a matter of actually building an ecosystem - and a lot of money: The market for automotive-related software alone is expected to grow to a value of 118 billion U.S. dollars by 2030 - falling short of the industry's existing expectations. Car manufacturers need to review their strategies, rely more on partnerships as well as coopetition - and consider standardization in certain areas," explains Constantin M. Gall, Automotive Industry Practice Leader and Managing Partner Europe West at EY Strategy and Transaction. "Automotive software transformation is not a sprint, but a marathon: traditional automotive manufacturers and suppliers need to have a strong focus and be clear about where they want to play, who they will partner with, if necessary, what skills and talent they need, and how their organizational structure can best support this transformation. Keeping the transformation manageable in terms of customer expectations, speed, cost and quality will certainly be the main difference between winners and losers."

Transitioning to a software business that works is not a no-brainer

Transitioning the business model to software-defined vehicles comes with challenges for OEMs: The industry lacks standardization, and zigzagging between open-source and proprietary software hinders automotive software innovation and scalability. In addition, the SDV field is highly competitive. Competitors are focusing heavily on the areas of radar systems and cameras, high-performance systems with special AD (autonomous driving) chips, AI, and operating systems for comprehensive user interface control. OEMs therefore need to focus on the right battles.

Transition phase progressing more slowly than expected

In the transition phase, the development of corresponding value pools will not progress as quickly as assumed due to the technical complexity - and will also be smaller in some segments: according to EY's Value Pool Forecaster, in some cases this will increase by more than 70 per cent in 2030 compared to earlier assumptions. Therefore, it is of particular importance to identify downgraded value pool sizes and adjust the SDV transformations accordingly.

EY estimates that the average investment required per OEM for SDV programs will be between one and five billion US dollars. New collaborations should make existing capabilities scalable and profitable. Companies should review their partnerships and focus them more on commercial success. Transformation programs must also be set up to answer important questions in advance: What is the status of the software in the overall context? How ambitious should the program be? What control should be exercised over the tech stacks?

The software transformation of suppliers and automotive manufacturers must happen holistically and within the framework of three steps

For a successful transformation, three basic aspects should be considered. First: knowledge of the company's own SDV value pools and weaknesses; second: preparation of the entire company, all people involved, technologies and capital for the process of transformation; and third: constant monitoring of the process and agile adaptation.

(1) Ensure software business readiness

Companies need to review their overall software business readiness. A holistic end-to-end analysis is important here. "Developing a working business model is a challenge for OEMs and Tier 1 suppliers because they have little experience in selling software or hardware-software bundles. They also need experience with product prototyping and pricing, as well as a roadmap for both monetization and quality assurance," emphasizes Jan Sieper, Partner Automotive Strategy at EY.

(2) Prepare the organization for transformation

The right cases can secure the interest of investors and thus the necessary capital for the transformation. The scalability of the SDV business and an authentic risk assessment are important. As far as data is concerned, external dependencies should be reduced as far as possible and data management processes harmonized. Finally, the availability of talent with software expertise also plays an important role. Efforts here pay off in particular: The study shows that OEMs with a clearly established software-focused branding approach are rated 68 percent higher than traditional OEMs with a hardware focus.

(3) Agile monitoring and adaptation of the process.

"As part of the SDV transformation, companies must constantly monitor all developments and factors and adjust their activities and systems as necessary. In doing so, it is important to always keep an eye on the central goals and use them as benchmarks. In addition, structures are needed that promote rapid decision-making. Most importantly, however, anyone who wants to emerge from this transformation as a winner must keep it manageable in terms of customer expectations, speed, costs, and quality," confirms Gall.

For more insights and to download the entire study, click here: Download Study

EY im Überblick

EY* ist eine der großen deutschen Prüfungs- und Beratungsorganisationen. In der Steuerberatung ist EY deutscher Marktführer. EY beschäftigt mehr als 11.000 Mitarbeitende an 20 Standorten. Gemeinsam mit den rund 365.000 Mitarbeitenden der internationalen EY-Organisation betreut EY Mandanten überall auf der Welt.

EY bietet sowohl großen als auch mittelständischen Unternehmen ein umfangreiches Portfolio von Dienstleistungen an: Wirtschaftsprüfung, Steuerberatung, Rechtsberatung, Strategy and Transactions, Consulting und Immobilienberatung.

Zusätzliche Informationen entnehmen Sie bitte der Internetseite www.de.ey.com.

*Der Name EY bezieht sich in diesem Profil auf alle deutschen Mitgliedsunternehmen von Ernst & Young Global Limited (EYG), einer Gesellschaft mit beschränkter Haftung nach englischem Recht. Jedes EYG Mitgliedsunternehmen ist rechtlich selbstständig und unabhängig und haftet nicht für das Handeln und Unterlassen der jeweils anderen Mitgliedsunternehmen.

Press contact:

Maike Störmer

+49 172 624 8798.

Press release distributed by Pressat on behalf of news aktuell, on Tuesday 12 September, 2023. For more information subscribe and follow https://pressat.co.uk/

Business & Finance

You just read:

Automotive companies at the crossroads: Turning software-defined vehicles from hype to value driver

News from this source: